8-K: Current report filing

Published on November 8, 2010

UNITED

STATES

SECURITIES

AND EXCHANGE COMMISSION

Washington,

D.C. 20549

FORM

8-K

CURRENT

REPORT

Pursuant

to Section 13 OR 15(d) of The Securities Exchange Act of 1934

Date of

Report (Date of earliest event reported): November 2, 2010

CommerceTel

Corporation

(Exact

name of registrant as specified in its charter)

|

Nevada

|

000-53851

|

26-3439095

|

||

|

(State

or Other Jurisdiction

|

(Commission

File

|

(I.R.S.

Employer

|

||

|

of

Incorporation)

|

Number)

|

Identification

Number)

|

8929 Aero

Drive, Suite E

San Diego, CA

92123

(Address

of principal executive offices) (zip code)

(866)622-4261

(Registrant’s

telephone number, including area code)

4600

Lamont Street #4-327

San Diego, CA 92109-3535

(Former

name or former address, if changed since last report)

Copies

to:

Louis A.

Brilleman, Esq.

1140

Avenue of the Americas, 9th

Floor

New York,

New York 10036

Phone:

(212) 584-7805

Fax:

(646) 380-6899

Check the

appropriate box below if the Form 8-K filing is intended to simultaneously

satisfy the filing obligation of the registrant under any of the following

provisions (see General Instruction A.2. below):

o Written communications

pursuant to Rule 425 under the Securities Act (17 CFR 230.425)

o Soliciting material

pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12)

o Pre-commencement

communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR

240.14d-2(b))

o Pre-commencement

communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR

240.13e-4(c))

Some of

the statements contained in this Form 8-K that are not historical facts are

“forward-looking statements” which can be identified by the use of terminology

such as “estimates,” “projects,” “plans,” “believes,” “expects,” “anticipates,”

“intends,” or the negative or other variations, or by discussions of strategy

that involve risks and uncertainties. We urge you to be cautious of

the forward-looking statements, in that such statements, which are contained in

this Form 8-K, reflect our current beliefs with respect to future events and

involve known and unknown risks, uncertainties, and other factors affecting our

operations, market growth, services, products, and licenses. No

assurances can be given regarding the achievement of future results, as actual

results may differ materially as a result of the risks we face, and actual

events may differ from the assumptions underlying the statements that have been

made regarding anticipated events. Such statements reflect our

current view with respect to future events and are subject to risks,

uncertainties, assumptions and other factors (including the risks contained in

the section of this report entitled “Risk Factors”) relating to our industry,

operations and results of operations and any businesses that we may acquire, and

include, without limitation:

1. Our

ability to attract and retain management, and to integrate and maintain

technical information and management information systems;

2. Our

ability to generate customer demand for our products;

3. The

intensity of competition; and

4.

General economic conditions.

Should

one or more of these risks or uncertainties materialize, or should the

underlying assumptions prove incorrect, actual results may differ significantly

from those anticipated, believed, estimated, expected, intended or

planned.

All

written and oral forward-looking statements made in connection with this Form

8-K that are attributable to us or persons acting on our behalf are expressly

qualified in their entirety by these cautionary statements. Although

we believe that the expectations reflected in the forward-looking statements are

reasonable, we cannot guarantee future results, levels of activity, performance

or achievements. Except as required by applicable law, including the securities

laws of the United States, we do not intend to update any of the forward-looking

statements to conform these statements to actual results. Given the

uncertainties that surround such statements, you are cautioned not to place

undue reliance on such forward-looking statements.

In this

report, unless otherwise specified, all dollar amounts are expressed in United

States dollars and all references to “common shares” refer to shares of our

common stock. The following discussion should be read in conjunction with the

audited annual financial statement, unaudited interim financial statements and

the related notes filed herein.

Unless

otherwise indicated or the context otherwise requires, all references below in

this current report on Form 8-K to “we”, “us”, “our”, and “the Company”, refer

to Ares Ventures Corp., a Nevada corporation, and its wholly-owned subsidiary,

CommerceTel, Inc.

Item

1.01 Entry into a Material Definitive Agreement.

Share

Exchange Agreement

On

November 2, 2010, CommerceTel Corporation, a Nevada corporation (the “Company”)

entered into a Share Exchange Agreement (the “Exchange Agreement”) with

CommerceTel Canada Corporation, an Ontario company and the principal shareholder

(the “Shareholder”) of CommerceTel, Inc., a Nevada corporation (“CommerceTel”),

as well as the other shareholders of CommerceTel (together with the Shareholder,

the “Sellers”), pursuant to which the Company purchased from the Sellers all

issued and outstanding shares of CommerceTel, in consideration for the issuance

to the Sellers of 10,000,000 shares of common stock of the Company (the “Share

Exchange”).

In

anticipation of the transaction, and as reported previously, effective October

5, 2010, the Company changed its name from Ares Ventures Corp. to CommerceTel

Corporation.

2

On

November 2, 2010, the Company issued to a number of accredited

investors a series of its 10% Senior Secured Convertible Bridge Note (the

“Notes”) in the aggregate principal amount of $1,000,000 (the

“Financing”). The Notes accrue interest at the rate of 10% per

annum. The entire principal amount evidenced by the Notes (the

“Principal Amount”) plus all accrued and unpaid interest is due on the earlier

of (i) the date the Company completes a financing transaction for the offer and

sale of shares of common stock (including securities convertible into or

exercisable for its common stock), in an aggregate amount of no less than 125%

of the principal amounts evidenced by the Notes (a “Qualifying Financing”), and

(ii) November 3, 2011.

On the

maturity date of the Notes, in addition to the repayment of the Principal Amount

and all accrued and unpaid interest, the Company will issue to each holder of

the Notes, at each such holder’s option, (i) three year warrants to purchase

that number of shares of its common stock equal to the Principal Amount plus all

accrued and unpaid interest divided by the per share purchase price of the

common stock offered and sold in the Qualifying Financing (the “Offering

Price”) which

warrants shall be exercisable at the Offering Price, or (ii) that number of

shares of Common Stock equal to the product arrived at by multiplying (x) the

Principal Amount plus all accrued and unpaid interest divided by the Offering

Price and (y) 0.33.

The

Company’s obligations under the Notes are secured by all of the assets of the

Company, including all shares of CommerceTel, its wholly owned

subsidiary.

WFG

Investments, Inc., a registered broker dealer, was paid a placement agent fee in

the amount of $40,000 for its services rendered in connection with the

Financing.

The

Company claims an exemption from the registration requirements of the Securities

Act of 1933, as amended (the “Act”), for the securities issued in the Share

Exchange and the Financing pursuant to Section 4(2) of the Act and/or Regulation

D promulgated there under since, among other things, the transaction did not

involve a public offering, the Investors are accredited investors and/or

qualified institutional buyers, the Investors had access to information about

the Company and their investment, the Investors took the securities for

investment and not resale, and the Company took appropriate measures to restrict

the transfer of the securities. As such, none of these securities may be offered

or sold in the United States unless they are registered under the Act, or an

exemption from the registration requirements of the Act is

available. No registration statement covering these securities has

been filed with the Securities Exchange Commission or with any state securities

commission.

Item

2.01 Completion of Acquisition or Disposition of Assets

On

November 2, 2010, the Company completed the transactions contemplated under the

Exchange Agreement. The Share Exchange resulted in a change in

control of the Company with the Shareholders owning in the aggregate 10,000,000

shares of common stock of the Company out of a total of 17,700,000 issued and

outstanding shares after giving effect to the Share Exchange. In

connection with the Share Exchange, subject to the Company’s compliance with the

provisions of Rule 14f under the Securities Exchange Act of 1934, as amended,

Shane Ellis, the sole director and officer of the Company prior to the Share

Exchange, resigned his position as an officer immediately, and as a director

effective on the date (the “Compliance Date”) the Company complies with the

filing and mailing requirements under Section 14(f) of the Securities Exchange

Act of 1934, as amended. Shareholder’s nominees were elected

directors of the Company, effective as of the Compliance Date, and appointed as

its executive officers, effective immediately

Pursuant

to the Exchange Agreement, the Shareholder transferred to the Company all of the

issued and outstanding shares of common stock of CommerceTel. In

consideration for the transfer of the shares of CommerceTel, the Company issued

an aggregate of 10,000,000 shares of common stock of the Company to the

Shareholders. As a result of the Exchange Agreement, (i) CommerceTel

became a wholly-owned subsidiary of the Company and (ii) the Company succeeded

to the business of CommerceTel as its sole business.

For

accounting purposes, the Share Exchange was treated as a recapitalization of

CommerceTel. CommerceTel is the accounting acquirer and the results

of its operations will be the results of the Company’s operations going

forward.

3

NOTE: The discussion contained

in this Item 2.01 relates primarily to CommerceTel. Information

relating to the business and results of operations of the Company and all other

information relating to the Company prior to the Share Exchange has been

previously reported in its Annual Report on Form 10-K for the year ended

December 31, 2009, and subsequent periodic filings with the Securities and

Exchange Commission and is herein incorporated by reference to those

reports.

Company

Overview

CommerceTel

is a provider of technology that enables major brands and enterprises to engage

consumers via their mobile phone. Interactive electronic communications with

consumers is a complex process involving communication networks and

software. CommerceTel removes this complexity through

its suite of services and technologies thereby enabling brands, marketers,

and content owners to communicate with their customers and consumers in

general. From Presidential elections to major broadcast events, we

are pioneers in the deployment of the mobile channel as the ultimate direct

connection to the consumer.

Mobile

phone users represent a large and captive audience. While

televisions, radios, and even PCs are often shared by multiple consumers, mobile

phones are personal devices representing a unique and individual address to the

end user. We believe that the future of digital media will be driven by mobile

phones where a direct, personal conversation can be had with the world’s largest

audience. The future of mobile includes banking, commerce,

advertising, video, games and just about every other aspect of both on and

offline life. Over four million consumers have been engaged via their mobile

device thanks to CommerceTel’s technology.

We

believe that our mobile marketing and advertising campaign platform is among the

most advanced in the industry as it allows real time interactive communications

with consumers. We generate revenue from licensing our software to

clients in our software as a service (Saas) model, per-message and per-minute

transactional fees, and customized professional services.

Our “C4”

Mobile Marketing and Customer Relationship Management (CRM) platform is a hosted

solution enabling our clients to develop, execute, and manage a variety of

engagements to a consumer’s mobile phone. Short Messaging Service (SMS),

Multi-Media Messaging (MMS), and Interactive Voice Response (IVR) interactions

can all be facilitated via a set of Graphical User Interfaces (GUIs). Reporting

and analytics capabilities are also available to our users through the C4

solution.

Mobile

devices are emerging as the principal interactive channel for brands to reach

consumers since it is the only media platform that has access to the consumer

virtually anytime and anywhere. Brands and advertising agencies are recognizing

the unique benefits of the mobile channel and they are increasingly integrating

mobile media within their overall advertising and marketing campaigns. Our

objective is to become the industry leader in connecting brands and enterprises

to consumers’ mobile phones.

Industry

Background

The area

of our business consists of advertising and marketing. While

advertising raises awareness and fosters positive perceptions of a product,

service or company through brand-building or individually-targeted campaigns,

marketing activities occur once the consumer decides to interact with the brand,

and are focused on convincing the consumer to take action, for example request

information, opt-in to a campaign, or make a purchase.

The

Mobile Marketing Association, the premier global non-profit trade association in

the area of mobile marketing, has defined mobile marketing as a set of practices

that enables organizations to communicate and engage with their audience in an

interactive and relevant manner through any mobile device or

network. Mobile marketing is commonly known as wireless

marketing.

Mobile

advertising is a rapidly growing business providing brands, agencies and

marketers the opportunity to connect with consumers beyond traditional and

digital media directly on their mobile phones. Today’s mobile phones

are utilized for more than just making and receiving calls. Besides voice

services, mobile users have access to data services such Short Message Service

(SMS), also known as text messaging, picture messaging, content downloads and

the Mobile Web. These media channels carry both content and advertising. The

mobile phone is an extremely personal device as each mobile phone typically has

one unique user. While televisions, radios, and even PCs are often

shared by multiple consumers, mobile phones are personal devices representing a

truly unique and individual address to the end user. This makes the mobile phone

a precisely targeted communication channel, where users are highly engaged with

content. As a result, the mobile channel is a highly effective campaign tool and

its response levels are high compared to other media. Mobile is valuable as a

stand-alone medium for advertising, but it’s also well suited for a vital role

in fully integrated cross-media campaign plans, including TV, print, radio,

outdoor, cinema, online and direct mail. We believe that the future

of digital media will be driven by mobile phones where a direct, personal

conversation can be had with the world’s largest network. The future

of mobile includes banking, commerce, advertising, video, games and just about

every other aspect of both on and offline life.

4

Mobile

advertising campaigns may use multiple channels to reach the consumer, including

Mobile Web sites, mobile applications, mobile messaging and mobile video, all of

which can be integrated into interactive campaigns. Each channel can

link to additional mobile content or channels, as well as to complementing

traditional media. Mobile advertising provides a powerful, instant and

interactive response path in that consumers may send a keyword to a short code

via SMS, or register on a Mobile Web site.

Mobile

Web

The

Mobile Web is fast emerging as a mainstream information, entertainment and

transaction source for people on the move and away from a

PC. Browsing the Mobile Web is similar to traditional PC-based Web

browsing and provides users with access to news, sports, weather, entertainment

and shopping sites. However, there are some significant differences

between PC-based access and phone-based access:

|

•

|

The

mobile phone is a targeted device with typically only one

user. This enable the delivery of relevant communications

causing users to become engaged immediately with campaigns and content

resulting in increased campaign

effectiveness.

|

|

•

|

Mobile

phones do not permit detailed search and delivery. Rather,

mobile users will usually seek quick access to succinct information and

services. Space on mobile phone screens is at a premium, and users have

limited input mechanisms, so Mobile Web sites need to be easy to navigate

using just the mobile phone keypad.

|

|

•

|

Mobile

phones have a broad range of different form factors, screen sizes and

resolutions, all of which presents a challenge for the display and optimal

viewing of content and advertising.

|

Mobile

Messaging

Mobile

messaging technology enables users to communicate in a so-called asynchronous

manner, where messages are stored in the network and delivered to the recipient

as soon as the recipient’s mobile phone can receive it. Once

delivered, the message is stored on the users’ mobile phone. SMS

(Short Messaging Service) allows a mobile user to send and receive a text

message of up to 160 characters and across virtually any operator

network. This service is also referred to as “text messaging” or

“texting”. All recent mobile phone models support SMS. As

a result, the large installed base of SMS phones creates a large addressable

market for SMS-based mobile marketing campaigns. MMS (Multimedia

Messaging Service) is the rich media equivalent to SMS text

messages. An MMS message can include graphics photos, audio and

video, in addition to text. MMS is not yet universally supported by all

networks, however this market segment is growing. SMS and MMS

services are together referred to as “mobile messaging” or “messaging”. The

stickiness of Mobile Messaging, the enormous reach of SMS and the rich media

capabilities of MMS make this channel a highly rewarding advertising

opportunity.

We

believe that mobile messaging represents an important opportunity for

advertising placement. Media publishers are using messaging to distribute mobile

content. Businesses are providing consumer services through mobile messaging.

These messages provide inventory into which advertisements can be inserted. In

addition, it is now possible to purchase advertising in person-to person (P2P),

SMS and MMS messages.

Mobile

devices have become one of the most widely used means of communication globally.

Significant technological advancements have and are continuing to provide mobile

users with increased access to features previously available only on PCs, such

as Internet browsing, email and social networking. As mobile devices have

evolved, they have begun to enable brands and advertising agencies to interact

with consumers virtually anytime and anywhere, optimizing engagement with other

traditional media while lowering the cost of customer acquisition and

retention.

As a

result, mobile devices have emerged as an important media method for brands and

advertising agencies to interact with consumers. According to a

national market research firm specializing in global connectivity and emerging

technology, mobile marketing and advertising spending is expected to increase

from $1.64 billion in 2007 to nearly $29 billion in 2014.

The

CommerceTel Solution

CommerceTel

resolves three key technical barriers needing to be overcome for the marketplace

to achieve the ultimate goal of engaging the consumer via their mobile

devices:

|

·

|

Multimodal

Communication: Cell phones are used for voice conversations, to

take pictures, sending and receiving SMS text messages, and several other

tasks. Marketers and enterprises need to include multiple communication

modalities when interacting with the mobile consumer. Engaging

only one channel to the mobile consumer, for example SMS text messaging,

will only result in a partial engagement with the

consumer. CommerceTel solves this problem via its carrier-grade

integrated infrastructure delivering access to all modes of mobile

communication from SMS to MMS to IVR and

beyond.

|

5

|

·

|

Campaign Design and

Management. The

ability to conceptualize, create, and execute mobile marketing campaigns

or enterprise applications in an efficient manner is affected by software

and tools available at any given time. Fragmented tool sets,

costly service models, and prolonged time-to-market will impede and impair

the growth of the industry. CommerceTel’s Web-based solution,

“C4”, is a unified services creation environment that enables brands and

enterprises to create, manage, and report on campaigns through a

set of hosted Web tools.

|

|

·

|

Analytics. Fragmented

analytic solutions (i.e. the lack of a uniform tool set used to analyze

mobile consumers’ preferences) only provide insights into disparate

modalities of the mobile channel. For example, a Mobile Web

analytics solution reveals a consumer’s Internet consumption while

neglecting that same consumer’s SMS and Voice related activities.

CommerceTel’s patent pending “Personalization Engine” leverages an

innovative approach to gaining deep insight into mobile consumer

activities and their associated

profiles.

|

Our

Principal Competitive Strength

We

believe that we have a significant advantage over our main competitors for the

following reasons:

|

·

|

Proprietary

Technology: Our proprietary, patent pending technology

enables our customers to reach across all mobile phone

interfaces. We continue to develop, design and deploy

enterprise-grade software that we believe is more advanced than

technologies developed by our competitors.

|

|

|

|

·

|

IVR and Voice

Capabilities: Our IVR and Voice capabilities allow marketers,

content owners, and search operators the freedom of engaging mobile

consumers outside of wireless carrier controlled messaging

networks. In many instances our competitors have outsourced

business to CommerceTel to fill gaps in their service

offerings. It is this fundamental advantage that has allowed

CommerceTel to quickly penetrate major brands.

|

|

·

|

In-house

Expertise: We believe that our primary technical

advantage is that we've built most of our systems in-house, relieving

us from costly software licensing fees associated with IVR platforms, SMS

messaging and other platforms. For example, IVR software

typically ranges from $150.00US to $1,000.00US per port, plus annual

maintenance and support fees. CommerceTel's current infrastructure

supports over 10,000 IVR ports without any associated IVR licensing costs.

In addition, there are unavoidable provisioning times for interconnecting

with VOIP and PSTN networks that can take a minimum of 90 days, plus

another 30 days for equipment

provisioning.

|

Our

Strategy

Our

objective is to become the industry leader in connecting brands and enterprises

to consumers’ mobile phones. We intend to simplify utilizing the

unique benefits of mobile marketing and advertising

campaigns. Following are the principal elements of our strategy are

to:

|

·

|

Capitalize upon current

customer relationships and acquire new

customers. We intend to capitalize on our

customer relationships to widen the appeal of our

solutions.

|

|

·

|

Enable our platform by

addressing technology shifts in mobile devices and

computing. The mobile device marketplace by

its nature undergoes constant change as new technologies and products

emerge. In particular, we believe that smartphone devices as well as

tablet computers with mobile capabilities are growing and becoming

increasingly important components of mobile communications. We devote

significant resources to address this evolving technology landscape with

innovative application interfaces for our platform that ensures we will be

well positioned to address the mobile marketplace as consumer device

preferences evolve.

|

|

·

|

Extend our leadership position

by continuing to invest in our platform. We

believe that the technical capabilities of our platform significantly

surpass the ability of our competitors to provide brands, advertising

agencies, mobile operators and media companies a comprehensive view of a

consumer's interaction and engagement across a variety of

media. We intend to continue to invest in, and enhance the

functionality of our platform and develop new technology solutions to

further strengthen and broaden our end-to-end platform.

|

|

·

|

Encourage the adoption of our

platform by third parties. Our platform

allows third parties, including content delivery platform providers,

application providers, campaign optimization specialists, mobile ad

networks, and analytic and billing providers, to use our platform to

execute marketing and advertising campaigns as well as to create new

business opportunities and technology innovations. We have designed our

platform to become central to the creation of a connected, global mobile

marketing and advertising marketplace, and we believe that this platform

will form the basis for a global mobile marketing and advertising

ecosystem.

|

6

|

·

|

Continue expansion and pursue

partnerships and acquisitions. We intend to

continue our expansion into new markets. In addition, we will

continue to evaluate and pursue strategic partnerships and acquisitions,

to continue strengthening our platform, increase our presence, expand

relationships and enter into new

markets.

|

Marketing

and Sales

We

believe that a successful marketing campaign addressed to mobile marketing and

content operators, particularly large agencies and brands, is largely dependent

on strong personal relationships with executives and a solutions-based sales

approach. We intend to employ an executive level sales team capable of fostering

direct relationships with brands while business development resources will focus

on channel partnerships through IT systems integrators and marketing

agencies.

Certain

minimum capitalization and financial levels are usually required by large

enterprises when seeking technical vendors. Therefore, we intend to

employ a partnership strategy in selling to large enterprises. Partnerships will

allow us to sell into larger enterprises during our early growth period by

avoiding having to meet these minimum capitalization levels.

The

Company also intends to employ a small executive level sales team and continue

its market leadership position with our large brand name client base

establishing credibility and entrée to prospective, targeted accounts across all

vertical segments. As key accounts are won, and the Company begins to scale, our

strategy will employ a core "Client Services" team to serve existing clients and

drive revenue growth from existing business, while a direct sales force will be

tasked with focusing exclusively on new client relationships.

Our

Platform

Mobile

marketing is quickly becoming an extension of Web-based marketing, and

potentially more powerful. Consumers rank their mobile device as more important

than their home computer. The ability to create and execute mobile marketing

campaigns or enterprise applications will be directly affected by software and

tools available to design and deliver solutions efficiently and

effectively. Fragmented tool sets, costly service models, and

prolonged time-to-market will impede and impair the growth of the

industry.

The

optimal mobile marketing campaign marries the rich interaction of the Web with

the immediacy that a mobile device can provide. The CommerceTel C4 platform integrates these

two technologies easily. CommerceTel’s proprietary Web-based

solution, “C4”, is a

unified services creation environment empowering brands and enterprises with the

ability to create, manage, and report on campaigns through a set of

hosted Web tools.

We

believe that our C4

platform makes it simple for users to have instant access to their mobile and

online site. Adding IVR or SMS messaging capabilities to a Website is easily

facilitated via the C4

API interface. This expands the reach a brand can enjoy by offering content

across a number of platforms.

The

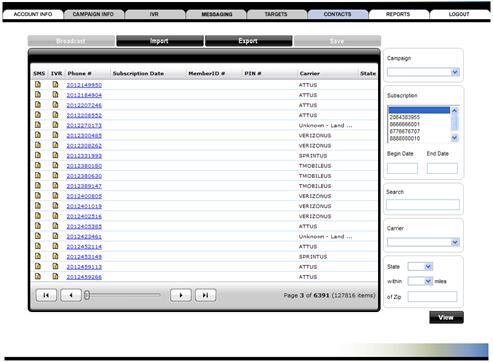

following two slides show actual screens of our C4 Web-based platform in

action.

7

8

Research

and Development

We

believe that having a dedicated, highly-trained advanced projects team enables

us to effectively address the rapidly evolving mobile marketing and advertising

services market. Accordingly, we have built a strong internal

software development team that has many years of experience in the mobile

advertising and marketing industries. As of June 30, 2010, we had

four engineers and software developers in our development centers located in San

Diego, CA. Our recent research and development activities have

been focused on making enhancements to our platform. Specifically,

our current research and development initiatives continue to focus on extending

our technology into payment processing, location based services, application

analytics, and other technical opportunities in the evolving mobile

industry.

Competition

Although

the market for mobile marketing and advertising solutions is relatively new, it

is very competitive. We compete with companies of all sizes in select

geographies that offer solutions that compete with single elements of our

platform, such as mobile advertising networks, mobile ad serving and ad routing

providers, mobile website and content creators, providers of mobile publishing

and application development, SMS aggregators or providers of mobile analytics.

We compete at times with interactive and traditional advertising agencies that

perform mobile marketing and advertising as part of their services to their

customers. Some of these entities have significantly greater

resources than we do.

As a

result of industry developments, some of our competitors may in the future

create an integrated platform with features similar to ours, for example,

Google, Inc.'s proposed acquisition of Admob, Inc. which was announced

in November 2009, Apple, Inc.'s acquisition of Quattro Wireless, Inc.

in January 2010, and the entry of larger companies such as Nokia, AOL, Microsoft

and Yahoo! into the mobile media markets. However, we do not directly compete

with these companies as we believe we are the only provider of an integrated,

end-to-end mobile marketing and mobile advertising platform with a significant

global presence.

We

believe that the key competitive factors that our customers use in selecting

solutions include the availability of:

|

·

|

an

integrated, scalable and relatively easy to implement platform that can

expand the reach of their future campaigns;

|

|

·

|

solutions

providing high quality functionality that meet their immediate marketing

and advertising needs;

|

|

·

|

sophisticated

analytics and reporting;

|

|

·

|

competitive

pricing;

|

|

·

|

existing

strategic relationships with customers globally;

|

|

·

|

high

levels of quality service and support; and

|

|

·

|

a

sophisticated and financially stable provider with a proven track

record.

|

We

believe that we compete favorably on each of these factors. Our extensive

experience managing global marketing and advertising campaigns, together with

experienced professional services to implement and integrate these options

globally, provides us with an advantage that many of our competitors

lack.

The

consolidation of our competitors offering point solutions into larger

organizations with increased resources is a recent trend in the industry. The

effects of such acquisitions on the market are still unclear.

Seasonality

Our

business, as is typical of companies in our industry, is highly seasonal. This

is primarily due to traditional marketing and advertising spending being

heaviest during the holiday season while brands, advertising agencies, mobile

operators and media companies often close out annual budgets towards the end of

a given year. Seasonal trends have historically contributed to, and

we anticipate will continue to contribute to fluctuations in our quarterly

results, including fluctuations in sequential revenue growth rates.

9

Intellectual

Property

We regard

the protection of our developed technologies and intellectual property rights as

an important element of our business operations and as crucial to our

success. We rely primarily on a combination of patent laws, trademark

laws, copyright laws, trade secrets, confidentiality procedures and contractual

provisions to protect our proprietary technology. We generally require our

employees, consultants and advisors to enter into confidentiality

agreements. These agreements provide that all confidential

information developed or made known to the individual during the course of the

individual's relationship with us is to be kept confidential and not disclosed

to third parties except under specific circumstances. In the case of our

employees, the agreements provide that all of the technology which is conceived

by the individual during the course of employment is our exclusive property. The

development of our technology and many of our processes are dependent upon the

knowledge, experience and skills of key scientific and technical

personnel.

We do not

own any patents. However, we have one pending U.S. patent

applications. Patent application 20070249369 was filed on

April 25, 2007. This patent application is described as a system,

method and apparatus for delivering Web content to a mobile telephone or related

device by using a dialing code is provided. In an exemplary

embodiment, a user who dials a telephone number, or other dialing code, and

subsequently receives content sent to the user's mobile handset. In

another embodiment, content is Web content sent to the user's phone via a

Wireless Application Protocol (WAP) process.

Any

future patents that may issue may not survive a legal challenge to their scope,

validity or enforceability, or provide significant protection for us. The

failure of our patents, or our reliance upon copyright and trade secret laws to

adequately protect our technology might make it easier for our competitors to

offer similar products or technologies. In addition, patents may not

issue from any of our current or any future applications.

Legal

Proceedings

We

currently, and from time to time, are, subject to claims arising in the ordinary

course of our business. We are not currently subject to any such claims that we

believe could reasonably be expected to have a material and adverse effect on

our business, results of operations and financial condition.

Employees

As of

September 30, 2010, we had 5 full-time employees and 3 contract

employees. Sales, marketing, and business development functions are

provided by one full time employee and one contract

consultant. Engineering and research and development functions are

provided by two full time employees and two contract

employees. General administration, finance, and executive management

consist of two full time employees.

Properties

We own no

real estate. We currently lease 3,751 square feet of office space

located at 8929 Aero Drive, Suite E, San Diego, CA 92123 at a monthly cost of

$5,441, and is believed to be suitable and adequate to meet current business

requirements. The original 60 month lease term expires June 30,

2012.

Government

Regulation

Mobile

data service providers are subject to regulations and laws applicable to

providers of mobile, Internet and voice over Internet protocol, or

VOIP. In addition, the application of existing domestic and

international laws and regulations relating to issues such as user privacy and

data protection, defamation, pricing, advertising, taxation, gambling,

sweepstakes, promotions, billing, real estate, consumer protection,

accessibility, content regulation, quality of services, telecommunications,

mobile, television and intellectual property ownership and infringement to

wireless industry providers and platforms in many instances is unclear or

unsettled. Further, the application of existing laws regulating or requiring

licenses for certain businesses of our advertisers can be unclear.

It is

possible that a number of laws and regulations may be adopted which may be

inconsistent and which could restrict the wireless communications industry,

including laws and regulations regarding network management and device

interconnection, lawful interception of personal data, taxation, content

suitability, copyright, distribution and antitrust. Furthermore, the growth and

development of the market for electronic storage of personal information may

prompt calls for more stringent consumer protection laws that may impose

additional burdens on companies that store personal information. We anticipate

that regulation of our industry generally will increase and that we will be

required to devote legal and other resources to address this

regulation.

10

We are

directly subject to certain regulations and laws applicable to providers of

Internet and mobile services both domestically and internationally. The

application of existing domestic and international laws and regulations relating

to issues such as user privacy and data protection, marketing, advertising,

consumer protection and mobile disclosures in many instances is unclear or

unsettled.

Regulatory

Environment

In

addition to its regulation of wireless telecommunications providers generally,

the U.S. Federal Communications Commission, or FCC, has shown interest in at

least three areas that impact our business: research and development with

regards to innovation, competition in the wireless industry and consumer

protection with an emphasis on truth-in-billing. The FCC has

examined, or is currently examining, how and when consumers enroll in mobile

services, what types of disclosures consumers receive, what services consumers

are purchasing and how much consumers are charged. In addition, the Federal

Trade Commission, or FTC, has been asked to regulate how mobile marketers can

use consumers' personal information. Consumer advocates claim that

many consumers do not know when their information is being collected from cell

phones and how such information is retained, used and shared with other

companies. Consumer groups have asked the FTC to identify practices that may

compromise privacy and consumer welfare; examine opt-in procedures to ensure

consumers are aware of what data is at issue and how it will be used;

investigate marketing tactics that target children and create policies to halt

abusive practices. The FTC has expressed interest in particular in the mobile

environment and services that collect sensitive data, such as location-based

information.

|

·

|

Deceptive Trade Practice

Law. The FTC and state attorneys general are

given broad powers by legislatures to curb unfair and deceptive trade

practices. These laws and regulations apply to mobile marketing campaigns

and behavioral advertising. The general guideline is that all material

terms and conditions of the offer must be "clearly and conspicuously"

disclosed to the consumer prior to the buying decision. In practice, the

definition of clear and conspicuous disclosure is often a subjective

determination. The balancing of the desire to capture a potential

customer's attention, while providing adequate disclosure, can be even

more challenging in the mobile context due to the lack of

space.

|

|

·

|

Behavioral

Advertising. Behavioral advertising is a

technique used by online publishers and advertisers to increase the

effectiveness of their campaigns. Behavioral advertising uses information

collected from an individual's web-browsing behavior, such as the pages

they have visited or the searches they have made, to select which

advertisements to display to that individual. This data can be valuable

for online marketers looking to personalize advertising initiatives or to

provide geo-tags through mobile devices. Currently, behavioral advertising

is not formally regulated in the U.S., but many businesses adhere to

industry self-governing principles, including an opt-out regime whereby

information may be collected until an individual indicates that he or she

no longer agrees to have this information collected. The FTC and EU member

states are considering regulations in this area, which may include

implementation of a more rigorous opt-in regime. An opt-in policy would

prohibit businesses from collecting and using information from individuals

who have not voluntarily consented. Among other things, the implementation

of an opt-in regime could require substantial technical support and

negatively impact the market for our mobile advertising products and

services. A few states have also introduced bills in the past two years

that would restrict or prohibit behavioral advertising within the state.

These bills would likely have the practical affect of regulating

behavioral advertising nationwide because of the difficulties behind

implementing state-specific policies or identifying the location of a

particular consumer.

|

|

·

|

Behavioral Advertising-Privacy

Regulation. Our business is affected by U.S.

federal and state laws and regulations governing the collection, use,

retention, sharing and security of data that we receive from and about our

users. In recent years, regulation has focused on the collection, use,

disclosure and security of information that may be used to identify or

that actually identifies an individual, such as an Internet Protocol

address or a name. Although the mobile and Internet advertising privacy

practices are currently largely self-regulated in the U.S., the FTC has

conducted numerous discussions on this subject and suggested that more

rigorous privacy regulation is appropriate, possibly including regulation

of non-personally identifiable information which could, with other

information, be used to identify an individual.

|

|

·

|

Marketing-Privacy

Regulation. In addition, there are U.S.

federal and state laws that govern SMS and telecommunications-based

marketing, generally requiring senders to transmit messages (including

those sent to mobile devices) only to recipients who have specifically

consented to receiving such messages. U.S. federal laws also govern e-mail

marketing, generally imposing an opt-out requirement for emails sent

within an existing business relationship.

|

|

·

|

SMS and Location-Based

Marketing Best Practices and Guidelines. We

are a member of the Mobile Marketing Association, or MMA, a global

association of 700 agencies, advertisers, mobile device manufacturers,

wireless operators and service providers and others interested in the

potential of marketing via the mobile channel. The MMA has published a

code of conduct and best practices guidelines for use by those involved in

mobile messaging activities. The guidelines were developed by a

collaboration of the major carriers and they require adherence to them as

a condition of service. We voluntarily comply with the MMA code of

conduct. In addition, the Cellular Telephone Industry Association, or

CTIA, has developed Best Practices and Guidelines to promote and protect

user privacy regarding location-based services. We also voluntarily comply

with those guidelines, which generally require notice and user consent for

delivery of location-based

services.

|

11

|

·

|

TCPA. The

United States Telephone Consumer Protection Act, or TCPA, prohibits

unsolicited voice and text calls to cell phones or the use of an

auto-dialing system unless the recipient has given prior consent. The

statute also prohibits companies from initiating telephone solicitations

to individuals on the national Do-Not-Call list, unless the individual has

given prior express consent or has an established business relationship

with the company, and restricts the hours when

such messages may be sent. In the case of text messages, a company must

obtain opt-in consent to send messages to a mobile device. Violations of

the TCPA can result in statutory damages of $500 per violation

(i.e., for each individual text message). U.S. state laws impose

additional regulations on voice and text calls.

|

|

·

|

CAN-SPAM. The

U.S. Controlling the Assault of Non-Solicited Pornography and Marketing

Act, or CAN SPAM, prohibits all commercial e-mail messages, as defined in

the law, to mobile phones unless the device owner has given "express prior

authorization." Recipients of such messages must also be allowed to

opt-out of receiving future messages the same way they opted-in. Senders

have ten days to honor opt-out requests. The FCC has compiled a list of

domain names used by wireless service providers to which marketers may not

send commercial e-mail messages. Senders have 30 days from the date

the domain name is posted on the FCC site to stop sending unauthorized

commercial e-mail to addresses containing the domain name. Violators are

subject to fines of up to $6.0 million and up to one year in jail for

some spamming activities. Carriers, the FTC, the FCC, and State Attorneys

General may bring lawsuits to enforce alleged violations of the

Act.

|

|

·

|

Communications Privacy

Acts. Foreign, U.S. federal and U.S. state

laws impose consent requirements for disclosures of contents of

communications or customer record information. To the extent that we

knowingly receive this information without the consent of customers, we

could be subject to class action lawsuits for statutory damages or

criminal penalties under these laws, which could impose significant

additional costs and reputational harm. EU member state laws also require

consent for our receiving this information, and if our carrier customers

fail to obtain such consent we could be subjected to civil or even

criminal penalties.

|

|

·

|

Security Breach Notification

Requirements. EU member state laws require

notice to the member state data protection authority of a data security

breach involving personal data if the breach poses a risk to individuals.

In addition, Germany recently enacted a broad requirement to notify

individuals in the event of a data security breach that is likely to be

followed by notification requirements to data subjects in other EU member

states. In the U.S., various states have enacted data breach notification

laws, which require notification of individuals and sometimes state

regulatory bodies in the event of breaches involving certain defined

categories of personal information. Japan and Uruguay have also

recently enacted security breach notice requirements. This new trend

suggests that breach notice statutes may be enacted in other

jurisdictions, including by the U.S. at the federal level, as

well.

|

|

·

|

Children. U.S.

federal privacy regulations implementing the Children's Online Privacy

Protection Act prohibit the knowing collection of personal information

from children under the age of 13 without verifiable parental consent, and

strictly regulate the transmission of requests for personal information to

such children. Other countries do not recognize the ability of children to

consent to the collection of personal information. In addition, it is

likely that behavioral advertising regulations will impose special

restrictions on use of information collected from minors for this

purpose.

|

12

MANAGEMENT’S

DISCUSSION AND ANALYSIS AND PLAN OF OPERATION

The

following discussion and analysis relates to the results of CommerceTel only and

should be read in conjunction with the consolidated financial statements and the

related notes thereto and other financial information contained elsewhere in

this Form 8-K.

General

Overview

CommerceTel

is a provider of technology that enables major brands and enterprises to engage

consumers via their mobile phone. Interactive electronic communications with

consumers is a complex process involving communication networks and

software. CommerceTel removes this complexity through

its suite of services and technologies thereby enabling brands, marketers,

and content owners to communicate with their customers and consumers in

general. From Presidential elections to major broadcast events, we

are pioneers in the deployment of the mobile channel as the ultimate direct

connection to the consumer.

Mobile

phone users represent a large and captive audience. While televisions, radios,

and even PCs are often shared by multiple consumers, mobile phones are personal

devices representing a truly unique and individual address to the end user. The

future of digital media will be driven by mobile phones where a direct, personal

conversation can be had with the world’s largest audience. The future of mobile

includes banking, commerce, advertising, video, games and just about every other

aspect of both on and offline life. Over 4 million consumers have been engaged

via their mobile device thanks to CommerceTel’s technology.

We

believe that our mobile marketing and advertising campaign platform is among the

most advanced in the industry as it allows real time interactive communications

with consumers. We generate revenue from licensing our software to

clients in our software as a service (Saas) model, per-message and per-minute

transactional fees, and customized professional services.

Our “C4”

Mobile Marketing and Customer Relationship Management (CRM) platform is a hosted

solution enabling our clients to develop, execute, and manage a variety of

engagements to a consumer’s mobile phone. Short Messaging Service (SMS),

Multi-Media Messaging (MMS), and Interactive Voice Response (IVR) interactions

can all be facilitated via a set of Graphical User Interfaces (GUIs). Reporting

and analytics capabilities are also available to our users through the C4

solution.

Mobile

devices are emerging as the principal interactive channel for brands to reach

consumers since it is the only media platform that has access to the consumer

virtually anytime and anywhere. Brands and advertising agencies are recognizing

the unique benefits of the mobile channel and they are increasingly integrating

mobile media within their overall advertising and marketing campaigns. Our

objective is to become the industry leader in connecting brands and enterprises

to consumers’ mobile phones.

Critical

Accounting Policies and Estimates

We

prepare our consolidated financial statements in accordance with accounting

principles generally accepted in the United States of America. The preparation

of these financial statements requires the use of estimates and assumptions that

affect the reported amounts of assets and liabilities and the disclosure of

contingent assets and liabilities at the date of the financial statements and

the reported amount of revenues and expenses during the reporting period. Our

management periodically evaluates the estimates and judgments

made. Management bases its estimates and judgments on historical

experience and on various factors that are believed to be reasonable under the

circumstances. Actual results may differ from these estimates.

The

following critical accounting policies affect the more significant judgments and

estimates used in the preparation of the Company’s consolidated financial

statements.

Revenue

recognition

We

recognize revenue when persuasive evidence of an arrangement exists, delivery

has occurred, the fee is fixed or determinable, and collectability is reasonably

assured. In the event that final acceptance of the product is

specified by the customer or is uncertain, revenue is deferred until all

acceptance criteria have been met. Cash received in advance of the

performance of services is recorded as deferred revenue.

Share-based

compensation cost is measured at the date of grant, based on the calculated fair

value of the stock-based award, and is recognized as expense over the employee’s

requisite service period (generally the vesting period of the

award). The Company estimates the fair value of employee stock

options granted using the Black-Scholes Option Pricing Model. Key assumptions

used to estimate the fair value of stock options include the exercise price of

the award, the fair value of the Company’s common stock on the date of grant,

the expected option term, the risk free interest rate at the date of grant, the

expected volatility and the expected annual dividend yield on the Company’s

common stock. We use comparable public company data among other

information to estimate the expected price volatility and the expected

forfeiture rate.

13

Results

of Operations

Year

Ended December 31, 2009 Compared to Year Ended December 31, 2008

Revenues

Revenues

for the 12 months ended December 31, 2009 decreased $408,111, or 30%, compared

to the 12 months ending December 31, 2008. This decrease in revenue

was due to the significant revenue earned in 2008 during the 6 months leading up

to the presidential election, which did not continue into 2009.

Cost

of Revenues

Cost of

revenue for the year ended December 31, 2009 increased $22,544, or 4.3%

compared to the same period in 2008. This cost increase resulted from

the increase of infrastructure related costs, including, but not limited to, SMS

aggregation expenses, increased IP bandwidth, and throughput increase required

to handle increased SMS traffic levels.

Gross

Profit

Gross

profit for the year ended December 31, 2009 decreased by $430,655, or 52%,

compared to the same period in 2008. Gross profit as a percentage of revenue for

the year ended December 31, 2009 decreased to 42% compared to 61% in

2008.

Operating

Expenses

Operating

expenses for the year ended December 31, 2009 decreased by $1.07 million,

or 39%, as compared to the same period in 2008, resulting from efforts to reduce

CommerceTel’s operating overhead. The majority of the decrease came

from reduction in personnel expenses of $860,000, reduction in equipment and

facility related expenses of $77,000, and reduction of other operating expenses

of $210,000.

Loss

From Operations

Net loss

for the year ended December 31, 2009 decreased $643,493, or 31%, compared to the

year ended December 31, 2008.

Interest

Expense

Interest

expense for the year ended December 31, 2009 increased $17,208, or 24.5%,

compared to the year ended December 31, 2008. This resulted from

increased borrowings in notes payable.

Net

Loss

Net Loss

for the year ended December 31, 2009 and December 31, 2008 were $1,402,627 and

$2,028,912 respectively.

Six

Months Ended June 30, 2010 Compared to Three and Six Months Ended June 30,

2009

Revenues

Revenues

for the six months ended June 30, 2010 increased by $2,789, or .6%, compared to

the same period in 2009.

Cost of

Revenues

Cost of

revenue for the six months ended June 30, 2010 decreased $69,646, or 23%

compared to the same period in 2009. Gross profit for the six months ended June

30, 2010 increased by $72,435, or 39%, compared to the same period in 2009. This

increase in gross profit was due to cost reductions in the areas of SMS

aggregation, expenses to increase throughput capacity, and TF/DID line

inventory.

14

Gross

Profit

Gross

profit for the six months ended June 30, 2010 increased by $72,435,

or 39%, compared to the same period in 2009. This increase in gross profit was

due to cost reductions in the areas of SMS aggregation, expenses to increase

throughput capacity, and TF/DID line inventory.

Other

Income (Expenses)

CommerceTel

had other income of $114,551 during the six months ended June 30, 2010 compared

to zero ($0) during the period ended June 30, 2009. This resulted

from negotiated debt settlements on past due amounts from 2008 and

2009.

Operating

Expenses

Operating

expenses for the six months ended June 30, 2010 decreased by

$203,170, or 23%, as compared to the same period in 2009. This decrease in operating expenses was due to efforts to

reduce cost across all expense categories. The majority of the

decrease came from reduction in personnel related expenses of $121,692 and legal

fees of $106,721, partially offset by increases in travel and

accounting/auditing expense.

Interest

Expense

Interest

expense for the six months ended June 30, 2010 decreased $19,884, or 36%,

compared to the same period in 2009. Interest expense was

attributable to Notes Payable outstanding during the respective

periods.

Net

Loss

Net Loss

for the six months ended June 30, 2010 and June 30, 2009 were $389,813 and

$814,774 respectively. Net Loss for the six months ended June 30,

2010 a credit of $114,551 resulting from renegotiated debt settlements with

various suppliers.

Liquidity

and Capital Resources

As of June 30, 2010, we had

current assets of $121,102, including cash of $15,297, and current liabilities

of $2,169,180. As of December 31, 2009, we had current assets

of $121,182, including cash of $11,003, and current liabilities of

$2,029,344.

Operating

Activities. Our operating activities

resulted in a net cash used by operations of $245,603 for the six months ended

June 30, 2010 compared to net cash used by operations of $189,464 for the six

months ended June 30, 2009. The net cash used by operations for the

six months ended June 30, 2010 reflects a net loss of $455,664 offset

by depreciation of $3,338, increase in accrued liabilities of $181,954, stock

based compensation $65,851, reduction in deferred revenues and customer deposits

of $40,432, and other minor factors. The net cash used by

operations for the six months ended June 30, 2009 reflects a net loss of

$877,384 offset by depreciation of $18,258, stock based compensation of

$62,611, increase in accrued liabilities of $560,257, increase of $42,063

in accounts receivable, and other minor factors.

Investing

Activities. Our investing activities

resulted in a net cash outflow of $0 for the six months ended June 30, 2010

compared to a net cash outflow of $0 for the six months ended June 30,

2009.

Financing

Activities. Our financing activities

resulted in a cash inflow of $249,897 for the six months ended June 30, 2010 and

$245,783 for the six months ended June 30, 2009, which represents proceeds of

capital contributions from parent.

Seasonality

Our

business, as is typical of companies in our industry, is highly seasonal. This

is primarily due to traditional marketing and advertising spending being

heaviest during the holiday season while brands, advertising agencies, mobile

operators and media companies often close out annual budgets towards the end of

a given year. Seasonal trends have historically contributed to, and

we anticipate will continue to contribute to fluctuations in our quarterly

results, including fluctuations in sequential revenue growth rates.

15

Recent

Accounting Pronouncements

Please

see our audited and reviewed financial statements for management’s discussion

relating to the impact of recent accounting pronouncements.

Quantitative

and Qualitative Disclosures about Market Risk

We are

exposed to several financial risks such as market risk (change in exchange

rates, changes in interest rates, market prices, etc.), credit risk and

liquidity risk. Our principal liabilities mainly consist of bank loans and trade

payables. The main purpose of these liabilities is to provide the necessary

funding for our operations. We have various financial assets such as trade

receivables and cash and cash equivalents. Our cash and cash equivalent

instruments are managed such that there is no significant concentration of

credit risk in any one bank or other financial institution. Management monitors

closely the credit quality of the financial institutions with which it holds

deposits.

Our

financing facilities are monitored against working capital and capital

expenditure requirements on a rolling 12-month basis and timely action is taken

to have the necessary level of available credit lines. Our policy is to

diversify funding sources. Management aims to maintain an appropriate capital

structure that ensures liquidity and long-term solvency.

We do not

have significant concentrations of credit risk relating to our trade receivables

and cash investments, and review the creditworthiness of our customers in

connection with our contracting activities. The maximum exposure to the credit

risk as of June 30, 2010 is primarily from trade receivables and accrued

contract receivables amounting to $49,606 in total. Trade receivables and

accrued contract receivables are typically unsecured and are derived from

revenue earned from customers. Credit risk is managed through credit approvals,

establishing credit limits and continuously monitoring the creditworthiness of

customers to which the company grants credit terms in the normal course of

business. It is our policy that all customers who wish to trade on credit terms

are subject to credit verification procedures. In addition, receivable balances

are monitored on an ongoing basis and historically our exposure to bad debts has

been minimal. Credit risk from cash balances is considered low. We restrict cash

transactions to high credit quality financial institutions.

Liquidity

Risk

Our

financing requirements have significantly increased due to the expansion of our

business, which has in the past been funded primarily through proceeds received

from contributions of capital from our parent company. Nevertheless, we monitor

our risk to a shortage of funds using a recurring cash flow planning model. Our

objective is to maintain a balance between continuity of funding and flexibility

through the availability of bank credit lines and the generation of positive

operating cash flows.

Off

Balance Sheet Arrangements

We do not

have any off balance sheet arrangements that are reasonably likely to have a

current or future effect on our consolidated financial condition, revenues,

results of operations, liquidity or capital expenditures.

16

RISK

FACTORS

An

investment in our securities involves a high degree of risk. In

determining whether to purchase our securities, you should carefully consider

all of the material risks described below, together with the other information

contained in this current report on Form 8-K before making a decision to

purchase our securities. You should only purchase our securities if you

can afford to suffer the loss of your entire investment.

Risks

Related to our Business

Proceeds

from our recent bridge financing may not be sufficient to sustain our operations

and we may need to raise additional capital to grow our business.

We

anticipate, based on currently proposed plans and assumptions relating to our

ability to market and sell our products, that our cash on hand including the

proceeds from our recent bridge as well as revenues from operations will satisfy

our operational and capital requirements for the next 12

months. However, the operation of our business and our efforts to

grow our business further will require significant cash outlays and commitments.

The timing and amount of our cash needs may vary significantly depending on

numerous factors, including but not limited to:

|

·

|

market

acceptance of our mobile marketing and advertising

services;

|

|

|

|

·

|

the

need to adapt to changing technologies and technical

requirements;

|

|

·

|

the

need to adapt to changing regulations requiring changes to our processes

or platform; and

|

|

·

|

the

existence of opportunities for

expansion.

|

If our

existing working capital and the proceeds from our recent bridge financing are

not sufficient to meet our cash requirements, we will need to seek additional

capital, potentially through debt, or other equity financings, to fund our

growth. We may not be able to raise cash on terms acceptable to us or at all.

Financings, if available, may be on terms that are dilutive to our shareholders,

and the prices at which new investors would be willing to purchase our

securities may be lower than the current price of our ordinary shares. The

holders of new securities may also receive rights, preferences or privileges

that are senior to those of existing holders of our ordinary shares. If new

sources of financing are required but are insufficient or unavailable, we would

be required to modify our growth and operating plans to the extent of available

funding, which could harm our ability to grow our business.

Our

sales efforts require significant time and effort and could hinder our ability

to expand our customer base and increase revenue.

Attracting

new customers requires substantial time and expense, especially in an industry

that is so heavily dependent on personal relationships with

executives. We cannot assure that we will be successful in

establishing new relationships, or maintaining or advancing our current

relationships. For example, it may be difficult to identify, engage and market

to customers who do not currently perform mobile marketing or advertising or are

unfamiliar with our current services or platform. Further, many of

our customers typically require input from one or more internal levels of

approval. As a result, during our sales effort, we must identify multiple people

involved in the purchasing decision and devote a sufficient amount of time to

presenting our products and services to those individuals. The

complexity of our services, including our software-as-a-service model, often

requires us to spend substantial time and effort assisting potential customers

in evaluating our products and services including providing demonstrations and

benchmarking against other available technologies. We expect that our

sales process will become less burdensome as our products and services become

more widely known and used. However, if this change does not occur,

we will not be able to expand our sales effort as quickly as anticipated and our

sales will be adversely affected.

We

may not be able to enhance our mobile marketing and advertising platform to keep

pace with technological and market developments, or to remain competitive

against potential new entrants in our markets.

The

market for mobile marketing and advertising services is emerging and is

characterized by rapid technological change, evolving industry standards,

frequent new product introductions and short product life cycles. Our current

platform or platforms we may offer in the future, may not be acceptable to

marketers and advertisers. To keep pace with technological developments, satisfy

increasing customer requirements and achieve acceptance of our marketing and

advertising campaigns, we will need to enhance our current mobile marketing

solutions and continue to develop and introduce on a timely basis new,

innovative mobile marketing services offering compatibility, enhanced features

and functionality on a timely basis at competitive prices. Our inability, for

technological or other reasons, to enhance, develop, introduce and deliver

compelling mobile marketing services in a timely manner, or at all, in response

to changing market conditions, technologies or customer expectations could have

a material adverse effect on our operating results or could result in our mobile

marketing services platform becoming obsolete. Our ability to compete

successfully will depend in large measure on our ability to maintain a

technically skilled development and engineering staff and to adapt to

technological changes and advances in the industry, including providing for the

continued compatibility of our mobile marketing services platform with evolving

industry standards and protocols. In addition, as we believe the mobile

marketing market is likely to grow substantially, other companies which are

larger and have significantly more capital to invest than us may emerge as

competitors. For example, in May 2010, Google, Inc. acquired Admob, Inc.

Similarly, in January 2010, Apple, Inc. acquired Quattro

Wireless, Inc. New entrants could seek to gain market share by introducing

new technology or reducing pricing. This may make it more difficult for us to

sell our products and services, and could result in increased pricing pressure,

reduced profit margins, increased sales and marketing expenses or the loss of

market share or expected market share, any of which may significantly harm our

business, operating results and financial condition.

17

Our

customer contracts lack uniformity and often are complex, which subjects us to

business and other risks.

Our

customers include some of the largest enterprises which have substantial

purchasing power and negotiating leverage. As a result, we typically negotiate

contracts on a customer-by-customer basis and our contracts lack uniformity and

are often complex. If we are unable to effectively negotiate, enforce and

account and bill in an accurate and timely manner for contracts with our key

customers, our business and operating results may be adversely

affected. In addition, we could be unable to timely recognize revenue

from contracts that are not managed effectively and this would further adversely

impact our financial results.

Our

services are provided on mobile communications networks that are owned and

operated by third parties who we do not control and the failure of any of these

networks would adversely affect our ability to deliver our services to our

customers.

Our

mobile marketing and advertising platform is dependent on the reliability of

mobile operators who maintain sophisticated and complex mobile networks. Such

mobile networks have historically, and particularly in recent years, been

subject to both rapid growth and technological change. If the network of a

mobile operator with which we are integrated should fail, including because of

new technology incompatibility, the degradation of network performance under the

strain of too many mobile consumers using it, or a general failure from natural

disaster or political or regulatory shut-down, we will not be able provide our

services to our customers through such mobile network. This in turn, would

impair our reputation and business, potentially resulting in a material, adverse

effect on our financial results.

If

our mobile marketing and advertising services platform does not scale as

anticipated, our business will be harmed.

We must

be able to continue to scale to support potential ongoing substantial increases

in the number of users in our actual commercial environment, and maintain a