PRE 14C: Preliminary information statement not related to a contested matter or merger/acquisition

Published on October 11, 2023

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

SCHEDULE 14C

Information Statement Pursuant to Section 14(c) of the

Securities Exchange Act of 1934

| Check the appropriate box: | |

| ☒ | Preliminary Information Statement |

| ☐ | Confidential, for Use of the Commission Only (as permitted by Rule 14c-5(d)(2)) |

| ☐ | Definitive Information Statement |

Mobivity Holdings Corp.

(Name of Registrant As Specified In Its Charter)

| Payment of Filing Fee (Check all boxes that apply): | |

| ☒ | No fee required. |

| ☐ | Fee paid previously with preliminary materials. |

| ☐ | Fee computed on table in exhibit required in Item 25(b) of Schedule 14A (17 CFR 240.14a-101) per Item 1 of this Schedule and Exchange Act Rules 14c-5(g) and 0-11. |

NOTICE OF STOCKHOLDER ACTION BY WRITTEN CONSENT

WE ARE NOT ASKING YOU FOR A PROXY AND YOU ARE REQUESTED NOT TO SEND US A PROXY

Dear Stockholder:

Mobivity Holdings Corp., a Nevada corporation (“we” or the “Company”), is delivering this Notice of Stockholder Action by Written Consent with the accompanying Information Statement to inform its stockholders that on October 5, 2023, the holders of a majority of votes entitled to be cast by all holders of the Company’s common stock, $0.001 par value per share (the “Common Stock”), on the recommendation of its Board of Directors (the “Board”), approved by written consent, in lieu of a stockholders meeting, to approve the Company’s 2022 Equity Incentive Plan (as amended, the “2022 Equity Plan”).

The 2022 Equity Plan was approved by the Board by unanimous written consent and recommended for approval by our stockholders pursuant to a stockholder action by written consent, as permitted under the Nevada Revised Statutes (“NRS”), and the Company’s Bylaws (the “Bylaws”). NRS § 78.320 (2) directs that any action that may be taken at a meeting of stockholders may be taken without a meeting if written consent thereto is signed by stockholders holding at least a majority of the voting power. Article II § 12 of the Bylaws permits stockholder action by written consent in accordance with the NRS. The 2022 Equity Plan has been approved by stockholder action pursuant to written consent as described hereto.

The Information Statement is being furnished to the holders of the Company’s Common Stock pursuant to § 14(c) of the Securities Exchange Act of 1934, as amended (“Exchange Act”), the NRS and the Bylaws, solely for the purpose of informing you of the 2022 Equity Plan before the same takes effect. Rule 14(c)-2 of the Exchange Act mandates that these actions will not become effective until at least twenty (20) calendar days after the mailing of this Notice and the accompanying Information Statement to stockholders. The Company intends to qualify the 2022 Equity Plan in compliance with filing and notification requirements.

You have the right to receive this Notice and the accompanying Information Statement if you were a stockholder of record at the close of business on October 5, 2023.

Sincerely,

Thomas

B. Akin

Chairman of the Board of Directors

MOBIVITY

HOLDINGS CORP.

3133 West Frye Road, #215

Chandler, Arizona 85226

(877) 282-7660

WE ARE NOT ASKING YOU FOR A PROXY AND YOU ARE ASKED NOT TO SEND US A PROXY

INFORMATION STATEMENT

INFORMATION STATEMENT PURSUANT TO SECTION 14C OF THE SECURITIES EXCHANGE ACT OF 1934, AS AMENDED.

THIS IS NOT A NOTICE OF AN ANNUAL MEETING OF STOCKHOLDERS AND NO STOCKHOLDER MEETING WILL BE HELD TO CONSIDER ANY MATTER DESCRIBED HEREIN. THE ACTIONS DESCRIBED IN THIS INFORMATION STATEMENT HAVE BEEN APPROVED BY HOLDERS OF A MAJORITY OF OUR COMMON STOCK. WE ARE NOT ASKING YOU FOR A PROXY AND YOU ARE REQUESTED NOT TO SEND US A PROXY. THERE ARE NO DISSENTERS’ RIGHTS WITH RESPECT TO THE ACTIONS DESCRIBED IN THIS INFORMATION STATEMENT.

INTRODUCTION

This Information Statement is being mailed or otherwise furnished to the holders of common stock, $0.001 par value per share (the “Common Stock”), of Mobivity Holdings Corp., a Nevada corporation (“we” or the “Company”) by the Board of Directors of the Company (the “Board”) to notify such holders about the approval of the adoption of the Company’s 2022 Equity Incentive Plan (as amended, the “2022 Equity Plan”) that the holders of a majority of the outstanding shares of the Company’s Common Stock have taken by written consent, in lieu of an annual meeting of the stockholders. The action was taken on October 5, 2023.

Copies of this Information Statement are first being sent on or about October [●], 2023 to the holders of record on October 5, 2023 of the outstanding shares of the Company’s Common Stock.

General Information

This Information Statement and Notice of Stockholder Action by Written Consent are being furnished by us to our stockholders of record as of October 5, 2023, to inform our stockholders that the Board and the holders of approximately 50.2% of our outstanding voting stock as of such date (the “Voting Stockholders”), have taken action and approved the adoption of the 2022 Equity Plan (the “Corporate Action”). The 2022 Equity Plan is attached as Exhibit A hereto.

The Company may ask brokers and other custodians, nominees, and fiduciaries to forward this Information Statement to the beneficial owners of the common stock held of record by such persons and will reimburse such persons for our-of-pocket expenses incurred in forwarding such material.

Dissenter’s Right of Appraisal

No dissenters’ or appraisal rights under the Nevada Revised Statutes are afforded to the Company’s stockholders as a result of the approval of the action set forth above.

Vote Required

The vote, which was required to approve the above action, was the affirmative vote of a majority of the outstanding shares of the Company’s Common Stock. Each holder of Common Stock is entitled to one (1) vote for each share of Common Stock held. The date used for purposes of determining the number of outstanding shares of the Company’s Common Stock entitled to vote is October 5, 2023. The record date for determining those stockholders of the Company entitled to receive this Information Statement is the close of business on October 5, 2023 (the “Record Date”). As of the Record Date, the Company had outstanding 67,949,709 shares of Common Stock. Holders of the Common Stock have no preemptive rights. All outstanding shares of Common Stock are fully paid and nonassessable. The transfer agent for the Common Stock is Colonial Stock Transfer Co, Inc.

| 1 |

Vote Obtained – Section 78.320 of the Nevada Revised Statutes

Section 78.320 of the Nevada Revised Statutes provides that any action required to be taken at any annual or special meeting of stockholders of a corporation, or any action which may be taken at any annual or special meeting of such stockholders, may be taken without a meeting, without prior notice and without a vote, if a consent or consents in writing, setting forth the action so taken, shall be signed by the holders of outstanding stock, having not less than the minimum number of votes that would be necessary to authorize or take such action at a meeting at which all shares entitled to vote thereon were present and voted.

To eliminate the costs and management time involved in soliciting and obtaining proxies to approve the actions and to effectuate the Corporate Action as early as possible to accomplish the purposes of the Company as hereafter described, the Board voted to utilize, and did in fact obtain, the written consent of the holders of a majority of the voting power of the Company. Thomas B. Akin, Talkot Fund LP, Ballyshannon Partners LP, Ballyshannon Family Partnership LP, Moglia Family Foundation, Odyssey Capital Group, Joseoh H. Moglia, Moglia Capital LLC, John R. Harris, Mark and Micheele Patterson Family Trust, Peter S Lynch Revocable Trust, The Lynch Foundation, Porter Partners, LP, Dennis Becker, Phillip Guarascio, Paul Moglia, and Robert Weeks are the consenting stockholders and their approximate ownership of the voting stock of the Company totals in the aggregate 50.2% of the Company’s outstanding shares of Common Stock.

This Information Statement is being distributed pursuant to the requirements of Section 14(c) of the Securities Exchange Act of 1934, as amended (the “Exchange Act”), to the Company’s stockholders on the Record Date. The Corporate Action described herein will be effective approximately 20 calendar days (the “20-day Period”) after the distribution of this Information Statement. The 20-day Period is expected to conclude on or about November [●], 2023.

The entire cost of furnishing this Information Statement will be borne by the Company.

ACTION

APPROVAL AND ADOPTION OF THE 2022 EQUITY INCENTIVE PLAN

Overview of Action

The Board and the holders of a majority of the voting power of the outstanding shares of capital stock of the Company have approved adoption of the Company’s 2022 Equity Incentive Plan (as amended, the “2022 Equity Plan”) effective as of October 5, 2023.

The Plan

The 2022 Equity Plan was adopted by the Board and became effective on September 19, 2022, was amended by the Board effective September 12, 2023, and was approved by our stockholders on October 5, 2023. The 2022 Equity Plan provides for the grant of awards to eligible employees, directors, consultants, consultants, and advisors.

Types of Awards Available Under the Plan

The 2022 Equity Plan permits the Company to grant the following types of awards to eligible individuals:

| ● | stock options (both incentive and non-qualified); | |

| ● | stock appreciation rights (“SARs”); | |

| ● | restricted stock awards; | |

| ● | stock unit awards; and | |

| ● | other stock-based awards. |

| 2 |

Total Number of Shares Available

Up to 12,000,000 shares (the “Shares” or, individually, a “Share”) of the Company’s common stock, par value $0.001 per share (the “Common Stock”), may be subject to awards issued under the 2022 Equity Plan.

Any shares forfeited, settled for cash, tendered or withheld to pay the exercise price or satisfy a tax withholding obligation in connection with any award, any shares repurchased by the Company using option exercise proceeds, and any shares subject to a SAR award that are not issued in connection with the stock settlement of that award upon its exercise will become available for future awards or replenish the 2022 Equity Plan share reserve.

Awards granted or shares of Common Stock issued under the 2022 Equity Plan upon the assumption of, or in substitution or exchange for, outstanding equity awards previously granted by an entity acquired by the Company or any of its affiliates or with which the Company or any of its affiliates combines (referred to as “substitute awards”) will not reduce the share reserve under the 2022 Equity Plan.

Additionally, if a company acquired by the Company or any of its subsidiaries, or with which the Company or any of its subsidiaries combines, has shares available under a pre-existing plan approved by its stockholders and not adopted in contemplation of such acquisition or combination, the shares available for grant pursuant to the terms of that pre-existing plan may be used for awards under the 2022 Equity Plan and shall supplement the share reserve under the 2022 Equity Plan, but only if the awards are made to individuals who were not employed by, or serving as a non-employee director of, the Company or any of its subsidiaries prior to such acquisition or combination.

Administration of the Plan

The 2022 Equity Plan is administered by the Compensation Committee (the “Committee”) appointed by the Company’s board of directors (the “Board”). Members of the Committee may be removed at any time by the Board. To the extent not inconsistent with applicable law or stock exchange rules, the Committee may delegate its authority under the 2022 Equity Plan to any one or more of its members or, with respect to awards to participants other than employees who are subject to Section 16 of the Securities Exchange Act of 1934, as amended, to one or more of the Company’s directors or executive officers or to a committee of the Company’s Board comprised of one or more directors. The Committee may also delegate non-discretionary administrative duties to other persons as it deems advisable. The Committee is authorized to establish rules for the administration of the 2022 Equity Plan as it deems appropriate, including establishing terms and conditions for the grant or exercise of any award under the 2022 Equity Plan.

Who Is Eligible to Participate in the Plan?

The Committee is authorized to select individuals from the following categories to receive awards under the 2022 Equity Plan:

| ● | employees of the Company or any of its subsidiaries; | |

| ● | non-employee directors; and | |

| ● | other natural persons who are not employees but who provide services to the Company or a subsidiary in the capacity of an advisor or consultant. |

Incentive stock option awards may only be awarded to U.S. employees of the Company or any of its subsidiaries. In this Information Statement, when we use the terms “employment” or “employed,” but not “employee,” we are also referring to providing service as a consultant, advisor or director, unless the context indicates otherwise.

| 3 |

The Term of the Plan

The 2022 Equity Plan will remain in effect until the earliest of the following: all Shares subject to the 2022 Equity Plan are distributed, the Board terminates the 2022 Equity Plan, or September 12, 2033 (the tenth anniversary of the Board’s approval of the 2022 Equity Plan as amended).

Amendment and Termination of the Plan

The Board may at any time terminate, suspend or amend the 2022 Equity Plan. No termination, suspension or amendment of the 2022 Equity Plan may, without the consent of the holder of an award, materially impair a holder’s rights under an award that was previously granted under the 2022 Equity Plan, unless such action is necessary to comply with applicable law or stock exchange rules. The Company will submit any amendment of the 2022 Equity Plan to its stockholders for approval only to the extent required by applicable laws, regulations or stock exchange requirements.

Award Agreements

The terms and conditions of each award granted under the 2022 Equity Plan must be evidenced by a written or electronic agreement in a form determined by the Committee, unless the award involves only the immediate issuance of unrestricted Shares. The Committee may amend an award agreement, but no amendment may materially impair a holder’s rights under an award without the holder’s consent, unless the amendment is necessary to comply with applicable law or stock exchange rules or any compensation recovery policy.

Types of Awards under the Plan

Stock Options and Stock Appreciation Rights

Stock Options

A stock option is a right to buy the Company’s stock at a future date and at a predetermined price. This is done by exercising the option and paying the Company the exercise price. There are two types of option awards that may be granted under the 2022 Equity Plan: (1) incentive stock options (also known as statutory options); and (2) non-statutory stock options (also known as non-qualified stock options).

Incentive stock options are those options designated as such by the Committee and that qualify for potentially favorable tax treatment by complying with the requirements of Section 422 of the Internal Revenue Code (the “Code”) or any successor provision. Incentive stock options are subject to the additional limitation that the fair market value (determined as of the option grant date) of the shares subject to all incentive stock options held by any one participant that first become exercisable in any calendar year may not exceed $100,000. No incentive stock options may be granted prior to September 12, 2023. All options other than incentive stock options are non-statutory stock options.

Stock Appreciation Rights

A stock appreciation right, or SAR, is the right to receive a payment generally equal to the appreciation in the fair market value of the Company’s stock from the date the SAR is granted to the date the SAR is exercised. A primary difference between SARs and stock options is that the participant does not pay the exercise price with a SAR. Instead, the participant, upon exercising a SAR, is entitled to receive from the Company the amount of the appreciation in the form of cash and/or Shares as determined by the Committee.

By way of example: A participant is granted 100 SARs with an exercise price set at $10. When the Share price increases to $15 per share, the participant exercises the SAR and is then able to receive the increased value of $5 per share, multiplied by the number of SARs, here 100, for a total of $500. This amount will be paid by the Company in Shares, cash or a combination of the two.

| 4 |

Exercise Price

The Committee will set the per Share exercise price for each option and SAR, which cannot be less than 100% of the fair market value of a Share on the grant date. However, for an incentive stock option granted to a participant who at the time of grant owns more than 10% of the Company’s voting stock, the exercise price cannot be less than 110% of a Share’s fair market value on the grant date.

Term and Vesting

Each option or SAR agreement will specify the term of the award and when the award vests and becomes exercisable. The term will not exceed:

| ● | ten years after the grant date; or | |

| ● | five years after the grant date for an incentive stock option that is granted to a participant who owns more than 10% of the Company’s voting stock. |

Exercise of Options and Stock Appreciation Rights

A participant can exercise an option by delivering a written or electronic notice of exercise to the Company or its designated agent. The purchase price of the shares with respect to which an option is exercised is payable in full at the time of exercise. The purchase price may be paid in cash or in such other manner as the Committee may permit, including by payment under a broker-assisted sale and remittance program, by withholding shares otherwise issuable to the participant upon exercise of the option or by delivery to the Company of shares (by actual delivery or attestation) already owned by the participant (in either case, such shares having a fair market value as of the date the option is exercised equal to the purchase price of the shares being purchased).

A participant may similarly exercise a SAR by delivering a notice of exercise to the Company or its designated agent. Upon the exercise of a SAR, a participant will receive payment at such time or times as shall be provided in the award agreement in the form of Company Shares, cash or a combination of Shares and cash as the Committee determines. The amount of cash and/or the fair market value of Shares received upon the exercise of a SAR will be, in the aggregate, equal to the amount by which the fair market value on the exercise date of the number of Shares as to which the SAR is being exercised exceeds the aggregate exercise price of those Shares.

The Committee may adopt a rule allowing it to provide in an award agreement for the automatic exercise of a non-qualified stock option.

Repricing

The Committee may, without stockholder approval: (i) reprice stock options or SARs, and (ii) pay cash or issue new awards in exchange for the surrender and cancellation of any, or all, outstanding options or SARs.

Restricted Stock Awards and Stock Unit Awards

Restricted Stock Awards

A restricted stock award is an award of Shares that vests at such times and in such installments as are determined by the Committee. Until the award vests, the Shares may not be transferred and are subject to forfeiture if the participant’s employment with the Company and its subsidiaries ends. The Committee may impose such restrictions or conditions to the vesting of restricted stock awards as it deems appropriate, including that the participant remain continuously in the Company’s service for a certain period, or that the Company, or any of its subsidiaries or business units, satisfy specified performance goals.

Any dividends or distributions payable with respect to shares that are subject to the unvested portion of a restricted stock award will be subject to the same restrictions and risk of forfeiture as the shares to which such dividends or distributions relate. Unless otherwise provided in an award agreement, participants are entitled to vote restricted shares prior to the time they vest.

| 5 |

Stock Unit Awards

A stock unit award is a right to receive the fair market value of a specified number of Shares, which amount may be payable in cash, Shares, or a combination of cash and Shares as the Committee determines. A stock unit award will vest at such times and in such installments as the Committee determines. Until it vests, a stock unit award may not be transferred and is subject to forfeiture if the participant’s employment with the Company and its subsidiaries ends. A participant’s award agreement may contain other conditions to vesting as well, such as a requirement that certain corporate, divisional or personal performance goals are satisfied. Unless and until Shares are issued in payment of a vested stock unit award, a participant will have no rights as a stockholder of the Company as a result of receiving a stock unit award. The Committee may, however, provide in a stock unit award agreement for the payment of dividend equivalents on vested units, subject to such conditions as the Committee may impose.

Vesting

The vesting provisions of each award are set forth in the applicable award agreement. To the extent any award fails to vest because a participant’s employment ends or because applicable performance goals are not satisfied, the award will be forfeited.

Other Stock-Based Awards

The Committee may grant awards of Shares and other awards that are valued by reference to and/or payable in Shares under the 2022 Equity Plan (other stock-based awards), including awards that are subject to performance conditions. The Committee has complete discretion in determining the terms and conditions of such awards.

Effect of a Termination of Employment

Generally, a stock option or SAR may only be exercised, and other awards only vest, while a participant is employed by (or providing service to) the Company, and then only if a participant has been continuously employed by (or providing service to) the Company since the date the award was granted.

If the participant is terminated for “cause” (generally defined to include misconduct by the participant), all unexercised options and SARs and the unvested portions of any other outstanding awards the participant holds will immediately be forfeited.

If the participant’s employment ends for any reason other than death, disability or cause, the unvested and unexercisable portions of any outstanding awards the participant holds will be immediately forfeited, and any vested and exercisable stock options or SARs held by a participant will remain exercisable until the earlier of:

| ● | three months after the date the participant’s employment ends; or | |

| ● | the end of the term of the option or SAR. |

If the participant’s employment with the Company ends because of death or disability, the participant’s vested stock options and SARs will remain exercisable for twelve months after the participant’s employment ends, but not beyond the original term of the award.

The Committee may, in individual award agreements, provide for different consequences upon a termination of employment.

| 6 |

Effect of a Change in Control

For purposes of the 2022 Equity Plan, a “Change in Control” generally occurs if: (i) any person or group becomes the beneficial owner of more than 50% of the voting power of the Company’s equity securities; (ii) a majority of the Board no longer consists of individuals who were directors at the time the 2022 Equity Plan was adopted or who, since that time, were nominated for election or elected by the Board; or (iii) a Corporate Transaction is consummated. A “Corporate Transaction” means a reorganization, merger, consolidation or share exchange involving the Company, or a sale of all or substantially all of the Company’s assets.

The effect of a Change in Control on outstanding awards under the 2022 Equity Plan is summarized below. The Committee may, however, provide for different consequences in individual award agreements and need not treat all awards in the same manner if a Change in Control occurs.

Awards Continued, Assumed or Replaced Following a Corporate Transaction

The vesting and exercisability of outstanding awards are not affected by a Change in Control which is a Corporate Transaction if:

| ● | the Company survives the Corporate Transaction and continues the awards under the 2022 Equity Plan; or | |

| ● | the surviving corporation (other than the Company) assumes or replaces the awards with comparable equity awards that preserve the intrinsic value of the awards at the time of the Corporate Transaction. For these purposes, the “intrinsic value” of stock options and SARs is measured by the difference between the fair market value (as determined by the Committee) at the time of the Change in Control of the Shares subject to an option or SAR and the exercise price of the option or SAR. |

If the participant is involuntarily terminated without cause by the Company or other surviving corporation within 12 months after a Corporate Transaction, then all of the participant’s outstanding options and SARs that were continued, assumed or replaced will fully vest and become exercisable and will remain exercisable for three months after the date the participant’s employment is terminated, and any of the participant’s other awards that were continued, assumed or replaced will fully vest. Any performance-based awards will vest at the target level of performance.

Accelerated Vesting and Payment of Awards

The Committee may provide in connection with a Change in Control which is Corporate Transaction that an option or SAR will fully vest and become fully exercisable for a period before the effective time of the Corporate Transaction and will terminate at the effective time of the Corporate Transaction. The Committee may also provide that any other outstanding and unvested award will fully vest immediately prior to the effective time of the Corporate Transaction.

The Committee may also elect to terminate awards in exchange for a payment with respect to each award in an amount equal to the excess, if any, between the fair market value (as determined by the Committee) of the Shares subject to the award immediately prior to the effective date of the Corporate Transaction over the aggregate exercise price, if any, for the Shares subject to such award. If there is no such excess amount in connection with a particular award, that award may be terminated in connection with the Corporate Transaction without any payment.

The Committee is not required to treat all awards or all participants similarly. If vesting of a performance-based award is accelerated or such awards are terminated in exchange for a cash payment, the Committee will determine the degree to which the vesting conditions have been satisfied.

| 7 |

Change in Control Not Involving a Corporate Transaction

If a Change in Control that does not involve a Corporate Transaction occurs, the Committee may provide, in the participant’s award agreement or otherwise, for any of the following outcomes:

| ● | any award will become fully vested and exercisable upon the Change in Control or upon the involuntary termination of the participant’s employment after the Change in Control; | |

| ● | any option or SAR will remain exercisable during all or some portion of its remaining term; or | |

| ● | awards will be canceled in exchange for payments in a manner similar to that described in the previous section regarding a Corporate Transaction. |

Limitation on Change in Control Payments

The 2022 Equity Plan provides that if any payments or benefits made available to a participant under the 2022 Equity Plan or other arrangements with the Company are contingent upon a Change in Control and would otherwise be characterized as a “parachute payment” under Code Section 280G, such payments and benefits will be reduced by the minimum amount necessary to avoid characterization as a parachute payment if doing so would provide a more favorable net after-tax result to a participant than if the payments and benefits were not reduced and the participant was subject to the excise tax imposed on excess parachute payments.

Federal Tax Consequences

The following is a brief summary of the principal United States federal income tax consequences to the Company and to participants subject to U.S. taxation with respect to awards granted under the 2022 Equity Plan, based on current statutes, regulations and interpretations. Because this is only a summary, there may be issues relevant to the participant’s personal situation which are not discussed. In addition, the tax laws and judicial and administrative interpretations of the tax laws could change in the future. There may also be foreign, state or local tax consequences that are not discussed in this summary. The following is not intended or written to be used, and cannot be used, for the purposes of avoiding taxpayer penalties. Because circumstances may vary, we advise all participants to consult their own tax advisors under all circumstances.

Non-Statutory Stock Options

If a participant is granted a non-qualified stock option under the 2022 Equity Plan, the participant will not recognize taxable income upon the grant of the option. Generally, the participant will recognize ordinary income at the time of exercise in an amount equal to the difference between the fair market value of the shares acquired at the time of exercise and the exercise price paid. The participant’s basis in the common stock for purposes of determining gain or loss on a subsequent sale or disposition of such shares generally will be the fair market value of our common stock on the date the option was exercised. The Company will generally be entitled to a federal income tax deduction at the time and for the same amount as the participant recognizes as ordinary income.

Incentive Stock Options

A participant will not recognize taxable income, and the Company will not be entitled to any related deduction, when the participant is granted an incentive stock option or when such an option vests. If the participant exercises an incentive stock option while employed or within three months after termination of the participant’s employment (or one year in the case of termination because of disability), the participant will not recognize ordinary income at that time. If the Shares acquired upon exercise are not disposed of until more than one year after the date of exercise and more than two years after the date of grant, then the excess of the sale proceeds over the aggregate exercise price of such Shares will be a long-term capital gain to the participant, and the Company will not be entitled to a tax deduction under such circumstances.

Except in the event of death, if the Shares are disposed of before the end of the one- or two-year holding periods described above (a “disqualifying disposition”), the excess of the fair market value of such Shares at the time of exercise over the aggregate exercise price (but generally not more than the amount of gain realized on the disposition) will be ordinary income to the participant at the time of such disqualifying disposition. The Company generally will be entitled to a federal tax deduction equal to the amount of ordinary income recognized by the participant. If an incentive stock option is exercised more than three months after termination of the participant’s employment (or one year in the case of termination because of disability), the tax consequences are the same as described for non-statutory stock options. If the participant pays the option price with Shares that were originally acquired pursuant to the exercise of an incentive stock option and the statutory holding periods for the Shares have not been met, the participant will be treated as having made a disqualifying disposition of the Shares, and the tax consequences of this disqualifying disposition will be as described for non-statutory stock options.

| 8 |

The excess of the fair market value of the shares acquired at the time of exercise over the aggregate exercise price is an item of tax preference income potentially subject to the alternative minimum tax.

Stock Appreciation Rights

Generally, the participant will not recognize taxable income upon the award or vesting of a stock appreciation right. The participant will recognize ordinary income, and the Company will be entitled to a corresponding deduction, when cash or Shares are delivered to the participant upon exercise of a stock appreciation right. The amount of ordinary income and deduction will be the amount of cash plus the fair market value of the Shares received on the date received. Upon a subsequent disposition of Shares received, any additional gain or loss realized will be taxed as capital gain or loss.

Restricted Stock Awards

Except as noted below, the participant will not recognize taxable income, and the Company will not be entitled to any related deduction, with respect to an award of restricted stock until the Shares vest. At that time, the participant will recognize ordinary income, and the Company will be entitled to a corresponding deduction, in an amount equal to the fair market value of the Shares on the day the Shares vest.

If the participant receives an award of restricted stock, the participant may irrevocably elect under Section 83(b) of the Code to report ordinary income in an amount equal to the fair market value of the Shares on the date of grant, and the Company will be entitled to a corresponding deduction. If the participant makes such an election, no income will be recognized at the time the Shares vest, and appreciation in the value of the Shares during the period of time they are subject to a risk of forfeiture will generally be recognized as capital gain only after the Shares vest and are sold or otherwise disposed of by the participant.

If, after making a Section 83(b) election, the participant forfeits some or all of the Shares subject to the participant’s restricted stock award, the participant cannot receive a refund of any taxes already paid with respect to those Shares, nor may the participant claim a deduction in connection with the forfeiture.

Any dividends the participant receives on Shares subject to a restricted stock award will be taxed as ordinary income to the participant and will also be deductible by the Company, unless the participant has made a Section 83(b) election. In that case, dividends will be taxed to the participant as dividend income.

Stock Unit Awards

The participant will not recognize taxable income at the time a stock unit award is granted or at the time it vests. Instead, the participant will recognize ordinary income at the time the participant receive payment for the participant’s vested stock units, in an amount equal to the amount paid in cash or the then-current fair market value of the Shares received, as applicable. The Company will ordinarily be allowed an income tax deduction at the time and in the amount of the ordinary income recognized by the participant in connection with the payment of a stock unit award. Stock unit awards will, however, be subject to Social Security and Medicare taxes at the time the units vest.

Other Stock-Based Awards

The participant will generally recognize ordinary income at the time the participant receives payment of a cash-based award, in an amount equal to the amount paid in cash or the then-current fair market value of any other property received. The Company will ordinarily be allowed an income tax deduction at the same time and in the same amount.

With respect to awards of unrestricted stock, the participant will recognize ordinary income on the date of grant in the amount of the fair market value of the Shares on such date, and the Company will be entitled to a corresponding deduction. The tax consequences of other awards will vary, depending on the terms of those awards.

| 9 |

Section 409A of the Code

The foregoing discussion of tax consequences of awards under the 2022 Equity Plan assumes that the award discussed is either not considered a “deferred compensation arrangement” subject to Section 409A of the Code or has been structured to comply with its requirements. If an award is considered a deferred compensation arrangement subject to Section 409A but fails to comply, in operation or form, with the requirements of Section 409A, the affected participant would generally be required to include in income when the award vests the amount deemed “deferred,” would be required to pay an additional 20% income tax on such amount, and would be required to pay interest on the tax that would have been paid but for the deferral.

Other Plan Provisions

Capital Adjustments

In the event of an equity restructuring that causes the per share value of Shares to change, such as stock splits, spinoffs, stock dividends or certain recapitalizations, the Committee will equitably adjust (a) the aggregate number and kind of Shares or other securities subject to the 2022 Equity Plan, (b) the number and kind of Shares or other securities subject to outstanding awards, (c) the exercise price of outstanding options and SARs, and (d) award limitations prescribed by the 2022 Equity Plan.

Restrictions on Transfer of Awards

During the lifetime of a participant, the only person who may exercise an option or SAR or receive payment with respect to any other award is the participant who received such award under this Plan or the participant’s guardian or legal representative.

In general, no right or interest in any award under the 2022 Equity Plan may be transferred or made subject to any security interest or lien, except that an award may be transferred in the case of the participant’s death in accordance with the participant’s will or the laws of descent and distribution. However, the Committee may provide in the participant’s award agreement that the participant may transfer an award (other than an incentive stock option) as a gift to a family member or pursuant to a qualified domestic relations order.

Any attempted transfer not permitted by the 2022 Equity Plan or an award agreement is ineffective. Where a transfer is authorized, the transferee continues to be subject to the terms and conditions of the award in place immediately before the transfer.

Recovery of Compensation

Any awards under the 2022 Equity Plan may be made subject to any compensation recovery or recoupment policy adopted by the Board or the Committee at any time, including after awards have been granted. Any such policy may provide for the recovery by the Company of compensation paid with respect to a Plan award where, for example, a 2022 Equity Plan participant is found to have violated Company policies or the compensation was paid based on Company financial results that are subsequently restated.

New Plan Benefits

The awards under the 2022 Equity Plan are within the discretion of the Committee. As a result, the benefits that will be awarded under the 2022 Equity Plan are not determinable at this time.

The following table summarizes the grants made to our named executive officers (as identified under “Executive Compensation”, below), all current executive officers as a group, all current non-executive directors as a group and all current non-executive employees as a group, from the effective date of the 2022 Equity Plan through October 5, 2023. The closing price per share of a Share of Common Stock on October 5, 2023 was $0.60.

| 10 |

| Name and position | Number of options | |||

| Dennis Becker, Chief Executive Officer | - | |||

| William T. Sanchez, Chief Financial Officer | 700,000 | |||

| Kimberly Carlson, Chief Operating Officer | 2,000,000 | |||

| Executive Group | 2,700,000 | |||

| Non-Executive Director Group | – | |||

| All Employees as a Group (Except Executive Officers) | 1,125,000 | |||

EXECUTIVE COMPENSATION

The following table summarizes the total compensation earned by our Chief Executive Officer (principal executive officer) and our other two most highly paid executive officers for the years ended December 31, 2022 and 2021.

Summary Compensation Table

The following table provides information regarding the compensation earned for 2022 and 2021 by our named executive officers:

| Salary | Bonus | Stock Awards | Option Awards | All Other Compensation |

Total | ||||||||||||||||||||||

| Name and Principal Position | Year | ($) | ($) | ($) | ($) | ($) | ($) | ||||||||||||||||||||

| Dennis Becker, Chairman & CEO | 2022 | 310,000 | 90,000 | — | — | — | 400,000 | ||||||||||||||||||||

| 2021 | 310,000 | 65,000 | — | — | — | 375,000 | |||||||||||||||||||||

| Lisa Brennan, CFO | 2022 | 225,000 | — | — | — | — | 225,000 | ||||||||||||||||||||

| 2021 | 225,000 | — | — | — | — | 225,000 | |||||||||||||||||||||

| 11 |

Outstanding Equity Awards at December 31, 2022*

The following table sets forth certain information regarding equity awards granted to our named executive officers and outstanding as of December 31, 2022:

| Name | Number of Securities Underlying Unexercised Options (#) Exercisable | Equity Incentive Plan Awards; Number of Securities Underlying Unexercised Unearned Options (#) | Option

Exercise Price |

Option Expiration Date |

||||||||||

| Dennis Becker, CEO & Chairman | 100,000 | — | $ | 1.28 | 1/22/2025 | |||||||||

| Dennis Becker, CEO & Chairman | 1,000,000 | — | $ | 0.60 | 5/15/2027 | |||||||||

| Dennis Becker, CEO & Chairman | 500,000 | 500,000 | (1) | $ | 1.04 | 5/17/2029 | ||||||||

| Lisa Brennan, CFO | 300,000 | 300,000 | (2) | $ | 1.55 | 12/7/2030 | ||||||||

* In accordance with the rules and regulations promulgated by the Securities and Exchange Commission, the table omits columns that are not applicable.

(1) Represents options that vested on May 17, 2023.

| (2) | This option vested as follows: 12,500 of the shares vest each month over a 48-month period which commenced on December 7, 2020, subject to continued service on each vesting date. |

Employment Agreements

We currently have an employment agreement with Dennis Becker. Prior to Ms. Brennan’s departure on June 21, 2023, we had an employment agreement with Ms. Brennan as well. Both of these agreements are described below.

Dennis Becker

On January 11, 2011, we entered into an employment agreement with Dennis Becker. Under the terms of the agreement, Mr. Becker has served as our President and Chief Executive Officer for an initial term of three years from December 24, 2010, and then under successive one-year renewal periods. Unless terminated no less than 90 days prior to the expiration date by either party, the agreement is renewed automatically for another year. Under the agreement, Mr. Becker was paid a base annual salary of $310,000 in 2022. The base salary is subject to an annual increase at the sole discretion of our board of directors. The board may further award him, at its sole discretion, an annual bonus of up to 50% of his base salary. He is eligible for stock options from time to time in the discretion of the Board.

If the employment agreement is terminated by us without Cause (as defined in the agreement) or if we notify Mr. Becker that we will not renew the agreement, we will be required to pay him a severance payment equal to six months of his base salary payable in regular intervals following such termination or expiration of the agreement.

The employment agreement includes non-compete, non-solicitation, intellectual property assignment and confidentiality provisions that are customary in our industry.

Lisa Brennan

On December 7, 2020, we appointed Lisa Brennan as Chief Financial Officer. In connection with the appointment, the Company entered into an employment agreement dated December 7, 2020 with Ms. Brennan. Lisa Brennan served as our Chief Financial Officer from December 7, 2020, to June 21, 2023.

Pursuant to her employment agreement, the Company agreed to pay Ms. Brennan an annual base salary of $225,000, subject to annual review by the board. Ms. Brennan was eligible for annual performance bonuses of up to 30% of her base salary for meeting key performance requirements, quotas, and assigned objectives determined annually by the board. Also pursuant to her employment agreement with the Company, Ms. Brennan was eligible to participate in all benefits, plans, and programs available to other executive employees of the Company. Ms. Brennan’s employment agreement contained standard provisions concerning noncompetition, nondisclosure, and indemnification.

| 12 |

2023 Subsequent Events

As disclosed in the Company’s Current Report on Form 8-K filed with the Securities and Exchange Commission on May 26, 2023, Ms. Brennan’s employment with the Company was terminated by the Company without Cause (as defined in the agreement) on June 21, 2023. The Company shall pay Ms. Brennan, in addition to all other amounts then due and payable, three additional monthly installments of her base salary, conditioned upon Ms. Brennan providing the Company with a valid and binding release of all claims against the Company and all recission periods relating to the release have been terminated. The release agreement included non-compete, non-solicitation, intellectual property assignment and confidentiality provisions that are customary in our industry.

Skye Fossey-Tomaske served as the Interim Chief Financial Officer of the Company from June 21, 2023, to July 5, 2023. Ms. Fossey-Tomaske serves as the Company’s corporate controller.

Effective on July 6, 2023, Mr. Sanchez was appointed Chief Financial Officer. His employment terms are provided in an offer letter agreement, which includes an annual salary of $280,000, a target incentive bonus of 33% of his base salary, and a grant of 700,000 stock options. His employment is at-will, and he executed a confidential information and invention assignment agreement.

As disclosed in the Company’s Current Report on Form 8-K filed with the Securities and Exchange Commission on July 27, 2023, Mr. Becker resigned from his position as the Company’s Chief Executive Officer and Chairman of the Board, effective as of September 1, 2023. Mr. Becker will continue to serve as a Director on the Board of the Company. Mr. Becker will also continue his service to the Company as a non-executive senior advisor on terms and conditions to be agreed upon at a later date.

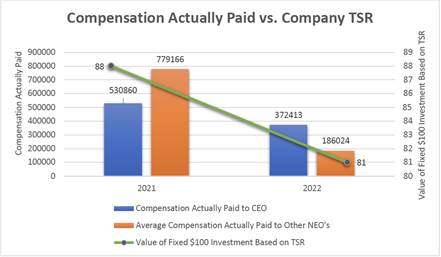

Pay Versus Performance Table

The following table sets forth additional compensation information of our CEO and our other NEOs (averaged) along with total stockholder return, and net income performance results for our fiscal years ending in 2021 and 2022:

|

Summary Compensation Table Total for CEO (1) ($) |

Compensation Actually Paid to CEO (1) (2) ($) |

Average Summary Compensation Table for Other NEOs (1) (2) ($) |

Average

Compensation Actually Paid to ($) |

Value of Initial Fixed $100 Investment Based on: Total Stockholder Return (3) ($) |

Net

Income ($ in thousands) |

|||||||||||||||||||

| 2022 | 400,000 | 372,413 | 225,000 | 200,767 | 81 | 400 | ||||||||||||||||||

| 2021 | 375,000 | 530,860 | 186,024 | 779,166 | 88 | 375 | ||||||||||||||||||

| (1) | For 2021 and 2022, the CEO was Dennis Becker and the Other NEO was Lisa Brennan. |

| (2) | None of our NEOs participate in a pension plan; therefore, no adjustment from the SCT total related to pension value was made. A reconciliation of Total Compensation from the Summary Compensation Table to Compensation Actually Paid to our CEO and our Other NEOs (as an average) is shown below: |

| 13 |

| 2022 | 2021 | |||||||||||||||

| Adjustments |

CEO ($) |

Average of Other NEOs ($) |

CEO ($) |

Average of Other NEOs ($) |

||||||||||||

| Total Compensation from SCT | 400,000 | 225,000 | 375,000 | 225,000 | ||||||||||||

| (Subtraction): SCT amounts of stock and option awards | 0 | 0 | 0 | 0 | ||||||||||||

| Addition: Fair value at year-end of awards granted during the covered fiscal year that are outstanding and unvested at year-end | 0 | 0 | 0 | 554,166 | ||||||||||||

| Addition (Subtraction): Year-over-year change in fair value of awards granted in any prior fiscal year that are outstanding and unvested at year end | (27,587 | ) | (26,335 | ) | 125,829 | 0 | ||||||||||

| Addition: Vesting date fair value of awards granted and vesting during such year | 0 | 0 | 0 | 0 | ||||||||||||

| Addition (Subtraction): Change as of the vesting date (from the end of the prior fiscal year) in fair value of awards granted in any prior fiscal year for which vesting conditions were satisfied during such year | 0 | (12,641 | ) | 30,031 | 0 | |||||||||||

| (Subtraction): Fair value at end of prior year of awards granted in any prior fiscal year that fail to meet the applicable vesting conditions during such year | 0 | 0 | 0 | 0 | ||||||||||||

| Addition: Dividends or other earnings paid on stock or option awards in the covered year prior to vesting if not otherwise included in the total compensation for the covered year | 0 | 0 | 0 | 0 | ||||||||||||

| Compensation Actually Paid (as calculated) | 372,413 | 186,024 | 530,860 | 779,166 | ||||||||||||

| (3) | Total stockholder return as calculated based on a fixed investment of one hundred dollars measured from the market close on December 31, 2020 (the last trading day of 2020) through and including the end of the fiscal year for each year reported in the table. |

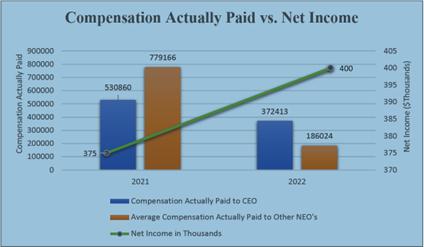

Relationship between Pay and Performance

The charts shown below presents a graphical comparison of Compensation Actually Paid to our CEO and the average Compensation Actually Paid to our Other NEOs set forth in the Pay Versus Performance Table above, as compared against the following performance measures: our (1) total stockholder return (“TSR”) and (2) net income.

Compensation Actually Paid versus TSR

| (1) | TSR in the above chart reflects the cumulative return of $100 as if invested in Company stock on December 31, 2020, including reinvestment of any dividends. |

| 14 |

Compensation Actually Paid versus Net Income

NON-EMPLOYEE DIRECTOR COMPENSATION

The following table provides information regarding compensation paid to and earned by non-employee directors during 2022:

| Name | Fees Earned or Paid in Cash | Stock Awards | Option Awards | Non-Equity Incentive Plan Compensation | Nonqualified Deferred Compensation Earnings | All Other Compensation | Total | |||||||||||||||||||||

| Doug Schneider | $ | 65,000 | $ | — | $ | — | $ | — | $ | — | $ | — | $ | 65,000 | ||||||||||||||

| Thomas Akin | $ | 65,000 | $ | — | $ | — | $ | — | $ | — | $ | — | $ | 65,000 | ||||||||||||||

| Philip Guarascio | $ | 65,000 | $ | — | $ | — | $ | — | $ | — | $ | — | $ | 65,000 | ||||||||||||||

| Benjamin Weinberger | $ | 48,750 | $ | — | $ | — | $ | — | $ | — | $ | — | $ | 48,750 | ||||||||||||||

| John Harris | $ | 16,250 | $ | — | $ | — | $ | — | $ | — | $ | — | $ | 16,250 | ||||||||||||||

| 15 |

EQUITY COMPENSATION PLAN INFORMATION

The following table provides information concerning equity compensation arrangements as of December 31, 2022, with respect to the shares of common stock that may be issued upon the exercise of options and other rights under our existing equity compensation plans and arrangements. The information includes the number of shares covered by, and the weighted average exercise price of, outstanding options and the number of shares remaining available for future grant, excluding the shares to be issued upon exercise of outstanding options.

| Plan Category |

Number of securities to be issued upon exercise of outstanding options (a) |

Weighted-average (b) |

Number of securities remaining available for future issuance under equity compensation plans (excluding securities reflected in column (a)) (c) |

|||||||||

| Equity compensation plans approved by security holders (1) | 5,511,216 | $1.22 per share | 3,388,658 | |||||||||

| Equity compensation plans not approved by security holders (2) | 1,800,000 | $1.05 per share | 10,820,000 | |||||||||

| Total | 7,311,216 | $1.18 per share | 14,208,658 | |||||||||

(1) Comprised of our 2010, 2013 and 2016 equity incentive plans.

(2) Comprised of our 2022 equity incentive plan.

SECURITY OWNERSHIP OF PRINCIPAL STOCKHOLDERS AND MANAGEMENT

The following table sets forth the beneficial ownership of our common stock, as of October 5, 2023, certain information regarding the beneficial ownership of (i) each person who, to our knowledge, beneficially owns more than 5% of our outstanding shares of Common stock; (ii) each of our directors and executive officers; and (iii) all of our executive officers and directors as a group. The number of shares owned includes all shares beneficially owned by such persons, as calculated in accordance with Rule 13d-3 promulgated under the Securities Exchange Act of 1934, as amended (the “Exchange Act”). The number of shares beneficially owned by a person includes shares of common stock underlying options or warrants held by that person that are currently exercisable or exercisable within 60 days of October 5, 2023. The shares issuable pursuant to the exercise of those options or warrants are deemed outstanding for computing the percentage ownership of the person holding those options and warrants but are not deemed outstanding for the purposes of computing the percentage ownership of any other person. Unless otherwise indicated, the address of each stockholder is c/o the Company, 3133 W. Frye Road, Chandler, AZ 85226.

| 16 |

| Amount and | ||||||||||

| Nature of | Percentage | |||||||||

| Beneficial | Outstanding | |||||||||

| Name and Address of Beneficial Owner | Ownership(a) | Shares(b) | ||||||||

| Greater than 5% Beneficial Owners: | ||||||||||

| Bruce E. Terker 950 West Valley Road, Suite 2900 Wayne, PA 19087 | 9,258,332 | (c) | 12 | % | ||||||

| Cornelius F. Wit 2700 N. Military Trail, Suite 210 Boca Raton, FL 33431 | 3,828,669 | (d) | 5 | % | ||||||

| Directors and Named Executive Officers | ||||||||||

| Dennis Becker | 2,292,003 | (e) | 3 | % | ||||||

| Doug Schneider | 657,429 | (f) | 1 | % | ||||||

| Benjamin Weinberger | 102,355 | (g) | 0 | % | ||||||

| Philip Guarascio | 580,304 | (h) | 1 | % | ||||||

| Thomas Akin | 27,130,471 | (i) | 34 | % | ||||||

| William T. Sanchez | 0 | (j) | 0 | % | ||||||

| Kimberly Carlson | 291,666 | (k) | 0 | % | ||||||

| All directors and current executive officers as a group (7 persons) | 31,079,619 | 40 | % | |||||||

| * | Less than one percent. |

| (a) | Unless otherwise indicated in a footnote below, (i) the listed beneficial owner has sole voting power and investment power with respect to such shares, and (ii) no director or executive officer has pledged as security any shares shown as beneficially owned. Includes shares subject to options that are currently exercisable and shares subject to options that are scheduled to become exercisable or vest and settle, as applicable, within 60 days of October 5, 2023 and shares, if any, held pursuant to employee stock purchase plans. The shares issuable pursuant to exercise of those options or warrants are deemed outstanding for computing the percentage ownership of the person holding those options and warrants but are not deemed outstanding for the purposes of computing the percentage ownership of any other person. Excludes fractional shares held by any listed beneficial owner |

| (b) | Applicable percentage of ownership is based upon 79,866,812 shares of common stock and exercisable options outstanding as of October, 5, 2023. |

| (c) | Based on Schedule 13G/A filed by with the SEC on February 2, 2023 by Bruce E. Terker, that he has shared voting power with respect to 7,861,082 shares and shared dispositive power with respect to 5,001,940 shares of our common stock. |

| (d) | Based on Schedule 13G/A filed with the SEC on February 16, 2022 by Cornelis F. Wit, that he has sole voting power with respect to 3,828,669 shares and sole dispositive power with respect to 3,828,669 shares of our common stock. |

| (e) | Includes 2,100,000 shares of common stock issuable pursuant to presently exercisable stock options, including options that will vest within 60 days of October 5, 2023. |

| (f) | Includes 517,114 shares of common stock issuable upon settlement of restricted stock units, including restricted stock units that will vest within 60 days of October 5, 2023. Includes 74,447 shares of common stock owned of record by The Schneider Family Trust. |

| (g) | Includes 102,355 shares of common stock issuable upon settlement of restricted stock units, including restricted stock units that will vest within 60 days of October 5, 2023. |

| (h) | Includes 528,307 shares of common stock issuable upon settlement of restricted stock units, including restricted stock units that will vest within 60 days of October 5, 2023. |

| (i) | Includes 10,778,960 shares of common stock owned of record by Talkot Fund, L.P., 466,440 shares of common stock issuable upon settlement of restricted stock units, including restricted stock units that will vest within 60 days of October 5, 2023 and 3,188,865 of stock warrants to purchase common stock. |

| (j) | As of 60 days from October 5, 2023, no stock options have vested. |

| (k) | Includes 291,666 shares of common stock issuable pursuant to presently exercisable stock options, including options that will vest within 60 days of October 5, 2023. |

HOUSEHOLDING

As permitted under the Exchange Act, in those instances where we are mailing a printed copy of this Information Statement, only one copy of this Information Statement is being delivered to stockholders that reside at the same address and share the same last name, unless such stockholders have notified the Company of their desire to receive multiple copies of this Information Statement. This practice, known as “householding,” is designed to reduce duplicate mailings and save significant printing and postage costs, as well as natural resources.

The Company will promptly deliver, upon oral or written request, a separate copy of this Information Statement to any stockholder residing at an address to which only one copy was mailed. Requests for additional copies should be directed to the Company by phone at (877) 282-7660 or by mail to Mobivity Holdings Corp., 3133 West Frye Road, #215, Chandler, AZ 85226. Stockholders residing at the same address and currently receiving multiple copies of this Information Statement may contact the Company at the address or telephone number above to request that only a single copy of an information statement be mailed in the future.

| 17 |

ADDITIONAL INFORMATION

Our annual report on Form 10-K for 2022, as filed with the SEC, is available on the SEC’s website, www.sec.gov, and our corporate website, www.mobivity.com, under “Investor Relations.” Copies of the annual report on Form 10-K will be sent to any stockholder without charge upon written request addressed to Mobivity Holdings Corp. at 3133 West Frye Road, #215, Chandler, Arizona 85226. Copies of exhibits to the annual report on Form 10-K may be obtained upon payment to us of the reasonable expense incurred in providing such exhibits.

By Order of the Board of Directors

| By: | /s/ Will Sanchez | |

| Name: | Will Sanchez | |

| Title: | Chief Financial Officer | |

| Date: | October [●], 2023 |

| 18 |

Exhibit A

Mobivity Holdings Corp.

2022 EQUITY INCENTIVE PLAN

1. Purpose. The purpose of the Mobivity Holdings Corp. 2022 Equity Incentive Plan (the “Plan”) is to attract and retain the best available personnel for positions of responsibility with the Company, to provide additional incentives to them and align their interests with those of the Company’s stockholders, and to thereby promote the Company’s long-term business success.

2. Definitions. In this Plan, the following definitions will apply.

(a) “Affiliate” means any entity that is a Subsidiary or Parent of the Company, or any other entity in which the Company owns, directly or indirectly, at least 20% of combined voting power of the entity’s Voting Securities and which is designated by the Committee as covered by the Plan.

(b) “Agreement” means the written or electronic agreement, notice or other document containing the terms and conditions applicable to each Award granted under the Plan, including all amendments thereto. An Agreement is subject to the terms and conditions of the Plan.

(c) “Award” means a grant made under the Plan in the form of Options, Stock Appreciation Rights, Restricted Stock, Stock Units, or an Other Stock-Based Award.

(d) “Board” means the Board of Directors of the Company.

(e) “Cause” means what the term is expressly defined to mean in a then-effective written agreement (including an Agreement) between a Participant and the Company or any Affiliate, or in the absence of any such then-effective agreement or definition a Participant’s (i) embezzlement or misappropriation of Company funds or property, (ii) failure to comply, as determined by the Company, with any applicable confidentiality, noncompetition or data security agreement or obligation, (iii) failure to comply, as determined by the Company, with any applicable Company policy; (iv) failure to perform satisfactorily the duties reasonably required of the Participant by the Company (other than by reason of Disability); (v) material violation of any law, rule, regulation, court order or regulatory directive (other than traffic violations, misdemeanors or other minor offenses); (vi) material breach of the Company’s business conduct or ethics code or of any fiduciary duty or nondisclosure, non-solicitation, non-competition or similar obligation owed to the Company or any Affiliate; (vii) engaging in any act or practice that involves personal dishonesty on the part of the Participant or demonstrates a willful and continuing disregard for the best interests of the Company and its Affiliates; or (viii) engaging in dishonorable or disruptive behavior, practices or acts which would be reasonably expected to harm or bring disrepute to the Company or any of its Affiliates, their business or any of their customers, employees or vendors.

(f) “Change in Control” means any one of the following:

(1) An Exchange Act Person becomes the beneficial owner (within the meaning of Rule 13d-3 under the Exchange Act) of securities of the Company representing more than 50% of the combined voting power of the Company’s then outstanding Voting Securities, except that the following will not constitute a Change in Control:

(A) any acquisition of securities of the Company by an Exchange Act Person from the Company for the purpose of providing financing to the Company;

| 1 |

(B) any formation of a Group consisting solely of beneficial owners of the Company’s Voting Securities as of the effective date of this Plan;

(C) any repurchase or other acquisition by the Company of its Voting Securities that causes any Exchange Act Person to become the beneficial owner of more than 50% of the Company’s Voting Securities; or

(D) with respect to any particular Participant, any acquisition of securities of the Company by the Participant, any Group including the Participant, or any entity controlled by the Participant or a Group including the Participant.

(E) If, however, an Exchange Act Person or Group referenced in clause (A), (B) or (C) above acquires beneficial ownership of additional Company Voting Securities after initially becoming the beneficial owner of more than 50% of the combined voting power of the Company’s Voting Securities by one of the means described in those clauses, then a Change in Control will be deemed to have occurred. Furthermore, a Change in Control will occur if a Person becomes the beneficial owner of more than 50% of the Company’s Voting Securities as the result of a Corporate Transaction only if the Corporate Transaction is itself a Change in Control pursuant to subsection 2(f)(3).

(2) Individuals who are Continuing Directors cease for any reason to constitute a majority of the members of the Board.

(3) A Corporate Transaction is consummated, unless, immediately following such Corporate Transaction, all or substantially all of the individuals and entities who were the beneficial owners of the Company’s Voting Securities immediately prior to such Corporate Transaction beneficially own, directly or indirectly, more than 50% of the combined voting power of the then outstanding Voting Securities of the surviving or acquiring entity resulting from such Corporate Transaction (including beneficial ownership through any Parent of such entity) in substantially the same proportions as their ownership, immediately prior to such Corporate Transaction, of the Company’s Voting Securities.

Notwithstanding the foregoing, if Award provides for a change in the time or form of payment upon a Change in Control, then no Change in Control shall be deemed to have occurred upon an event described in this Section 2(f) unless the event would also constitute a change in ownership or effective control of, or a change in the ownership of a substantial portion of the assets of, the Company under Section 409A.

(g) “Code” means the Internal Revenue Code of 1986, as amended and in effect from time to time. For purposes of the Plan, references to sections of the Code shall be deemed to include any applicable regulations thereunder and any successor or similar statutory provisions.

(h) “Committee” means two or more Non-Employee Directors designated by the Board to administer the Plan under Section 3, each member of which shall be (i) an independent director within the meaning of applicable stock exchange rules and regulations and (ii) a non-employee director within the meaning of Exchange Act Rule 16b-3. The Committee shall be the Compensation Committee of the Board unless otherwise specified by the Board.

(i) “Company” means Mobivity Holdings Corp., a Nevada corporation, and any successor thereto.

(j) “Continuing Director” means an individual (i) who is, as of the effective date of the Plan, a director of the Company, or (ii) who becomes a director of the Company after the effective date hereof and whose initial election, or nomination for election by the Company’s stockholders, was approved by at least a majority of the then Continuing Directors, but excluding, for purposes of this clause (ii), an individual whose initial assumption of office occurs as the result of an actual or threatened proxy contest involving the solicitation of proxies or consents by a person or Group other than the Board, or by reason of an agreement intended to avoid or settle an actual or threatened proxy contest.

| 2 |

(k) “Corporate Transaction” means (i) a sale or other disposition of all or substantially all of the assets of the Company, or (ii) a merger, consolidation, share exchange or similar transaction involving the Company, regardless of whether the Company is the surviving entity.

(l) “Disability” means (A) any permanent and total disability under any long-term disability plan or policy of the Company or its Affiliates that covers the Participant, or (B) if there is no such long-term disability plan or policy, “total and permanent disability” within the meaning of Code Section 22(e)(3).

(m) “Employee” means an employee of the Company or an Affiliate.

(n) “Exchange Act” means the Securities Exchange Act of 1934, as amended and in effect from time to time.

(o) “Exchange Act Person” means any natural person, entity or Group other than (i) the Company or any Affiliate; (ii) any employee benefit plan (or related trust) sponsored or maintained by the Company or any Affiliate; (iii) an underwriter temporarily holding securities in connection with a registered public offering of such securities; or (iv) an entity whose Voting Securities are beneficially owned by the beneficial owners of the Company’s Voting Securities in substantially the same proportions as their beneficial ownership of the Company’s Voting Securities.

(p) “Exchange Program” means a program under which (i) outstanding Options or SARs are surrendered or cancelled in exchange for Options or SARs of the same type (which may have lower or higher exercise prices and different terms), Awards of a different type and/or cash, or (ii) the exercise price of an outstanding Option or SAR is reduced.

(q) “Fair Market Value” means the fair market value of a Share determined as follows:

(1) If the Shares are readily tradable on an established securities market (as determined under Section 409A), then Fair Market Value will be the closing sales price for a Share on the principal securities market on which it trades on the date for which it is being determined, or if no sale of Shares occurred on that date, on the next preceding date on which a sale of Shares occurred, as reported in The Wall Street Journal or such other source as the Committee deems reliable; or

(2) If the Shares are not then readily tradable on an established securities market (as determined under Section 409A), then Fair Market Value will be determined by the Committee as the result of a reasonable application of a reasonable valuation method that satisfies the requirements of Section 409A.

(r) “Full Value Award” means an Award other than an Option Award or Stock Appreciation Right Award.

(s) “Global Service Provider” means a Service Provider who is located outside of the United States, who is not compensated from a payroll maintained in the United States, or who is otherwise subject to (or could cause the Company to be subject to) legal, tax or regulatory requirements of countries outside of the United States.

| 3 |

(t) “Good Reason” means what the term is expressly defined to mean in a then-effective written agreement (including an Agreement) between a Participant and the Company or any Affiliate, or in the absence of such then-effective agreement or definition, means the existence of one or more of the following conditions without the Participant’s written consent, so long as the Participant provided written notice to the Company of the existence of the condition not later than 90 days after the initial existence of the condition, the condition has not been remedied by the Company within 30 days after its receipt of such notice, and the Participant terminates the Participant’s employment within 180 days of the initial existence of the condition: (i) any material, adverse change in the Participant’s duties, responsibilities, or authority; (ii) a material reduction in the Participant’s base salary or bonus opportunity that is not part of a general reduction applicable to employees in the same classification or grade as the Participant; or (iii) a geographical relocation of the Participant’s principal office location by more than 50 miles, provided that (A) if the Participant’s principal place of Services is the Participant’s personal residence, this clause (iii) shall not apply and (B) neither the Participant’s relocation to remote work or back to the office from remote work will be considered a relocation of such employee’s principal location of Services for purposes of this definition.

(u) “Grant Date” means the date on which the Committee approves the grant of an Award under the Plan, or such later date as may be specified by the Committee on the date the Committee approves the Award.

(v) “Group” means two or more persons who act, or agree to act together, as a partnership, limited partnership, syndicate or other group for the purpose of acquiring, holding, voting or disposing of securities of the Company.

(w) “Non-Employee Director” means a member of the Board who is not an Employee.

(x) “Option” means a right granted under the Plan to purchase a specified number of Shares at a specified price. An “Incentive Stock Option” or “ISO” means any Option designated as such and granted in accordance with the requirements of Code Section 422. A “Non-Qualified Stock Option” or “NQSO” means an Option other than an Incentive Stock Option.

(y) “Other Stock-Based Award” means an Award described in Section 11 of this Plan.

(z) “Parent” means a “parent corporation,” as defined in Code Section 424(e).

(aa) “Participant” means a Service Provider to whom a then-outstanding Award has been granted under the Plan.

(bb) “Performance-Based Award” means an Award that is conditioned on the achievement of specified performance goals.

(cc) “Plan” means this Mobivity Holdings Corp. 2022 Equity Incentive Plan, as amended and in effect from time to time.

(dd) “Restricted Stock” means Shares issued to a Participant that are subject to such restrictions on transfer, vesting conditions and other restrictions or limitations as may be set forth in this Plan and the applicable Agreement.

| 4 |

(ee) “Section 409A” means Section 409A of the Code, and the regulations and guidance promulgated thereunder.

(ff) “Service” means the provision of services by a Participant to the Company or any Affiliate in any Service Provider capacity. A Service Provider’s Service shall be deemed to have terminated either upon an actual cessation of providing services to the Company or any Affiliate or upon the entity to which the Service Provider provides services ceasing to be an Affiliate. Except as otherwise provided in this Plan or any Agreement, Service shall not be deemed terminated in the case of (i) any approved leave of absence; (ii) transfers among the Company and any Affiliates in any Service Provider capacity; or (iii) any change in status so long as the individual remains in the service of the Company or any Affiliate in any Service Provider capacity.

(gg) “Service Provider” means an Employee, a Non-Employee Director, or any natural person who is a consultant or advisor, or is employed by a consultant or advisor retained by the Company or any Affiliate, and who provides services (other than in connection with (i) a capital-raising transaction or (ii) promoting or maintaining a market in Company securities) to the Company or any Affiliate.

(hh)“Share” means a share of Stock.

(ii) “Stock” means the common stock, $.001 par value per Share, of the Company.

(jj) “Stock Appreciation Right” or “SAR” means the right to receive, in cash and/or Shares as determined by the Committee, an amount equal to the appreciation in value of a specified number of Shares between the Grant Date of the SAR and its exercise date.

(kk) “Stock Unit” means a right to receive, in cash and/or Shares as determined by the Committee, the Fair Market Value of a Share, subject to such restrictions on transfer, vesting conditions and other restrictions or limitations as may be set forth in this Plan and the applicable Agreement.

(ll) “Subsidiary” means a “subsidiary corporation,” as defined in Code Section 424(f), of the Company.

(mm) “Substitute Award” means an Award granted upon the assumption of, or in substitution or exchange for, outstanding awards granted by a company or other entity acquired by the Company or any Affiliate or with which the Company or any Affiliate combines. The terms and conditions of a Substitute Award may vary from the terms and conditions set forth in the Plan to the extent that the Committee at the time of the grant may deem appropriate to conform, in whole or in part, to the provisions of the award in substitution for which it has been granted.

(nn) “Voting Securities” of an entity means the outstanding equity securities (or comparable equity interests) entitled to vote generally in the election of directors of such entity.

3. Administration of the Plan.

(a) Administration. The authority to control and manage the operations and administration of the Plan shall be vested in the Committee in accordance with this Section 3.

(b) Scope of Authority. Subject to the terms of the Plan, the Committee shall have the authority, in its discretion, to take such actions as it deems necessary or advisable to administer the Plan, including:

(1) determining the Service Providers to whom Awards will be granted, the timing of each such Award, the type of and the number of Shares or amount of cash covered by each Award, the terms, conditions, performance criteria, restrictions and other provisions of Awards, and the manner in which Awards are paid or settled;

| 5 |

(2) cancelling or suspending an Award, accelerating the vesting or extending the exercise period of an Award, or otherwise amending the terms and conditions of any outstanding Award, subject to the requirements of Section 15(d);

(3) adopting sub-plans or special provisions applicable to Awards, establishing, amending or rescinding rules to administer the Plan, interpreting the Plan and any Award or Agreement, reconciling any inconsistency, correcting any defect or supplying an omission or reconciling any inconsistency in the Plan or any Agreement, and making all other determinations necessary or desirable for the administration of the Plan;

(4) granting Substitute Awards under the Plan;

(5) taking such actions as are provided in Section 3(c) with respect to Awards to Global Service Providers;